Cruso 1A

A maker of solid wood furniture and objects

€325,900

total amount raised

- Backed by over 60 investors

- Eligible for a tax reduction

This campaign has been closed

Historical accounts

The products have been presented under the Cruso brand for some years, however they have not yet been commercialized on a global scale. The company (Cruso sprl/bvba) has been recently founded in September 2018 to start the commercialization of products. First annual closing will take place on 31st December 2019.

Accounts Governance : The executive team will execute its strategy in the spirit of open communication with its investors, in order to provide them with regular feedback about the evolution of the main commercial metrics and the execution progress. The executive team commits to a detailed activity report at least bi-annualy. The Board of Advisors will be consulted for important strategic decisions, with a written memo about the Board’s feedback and advice being distributed to shareholders.

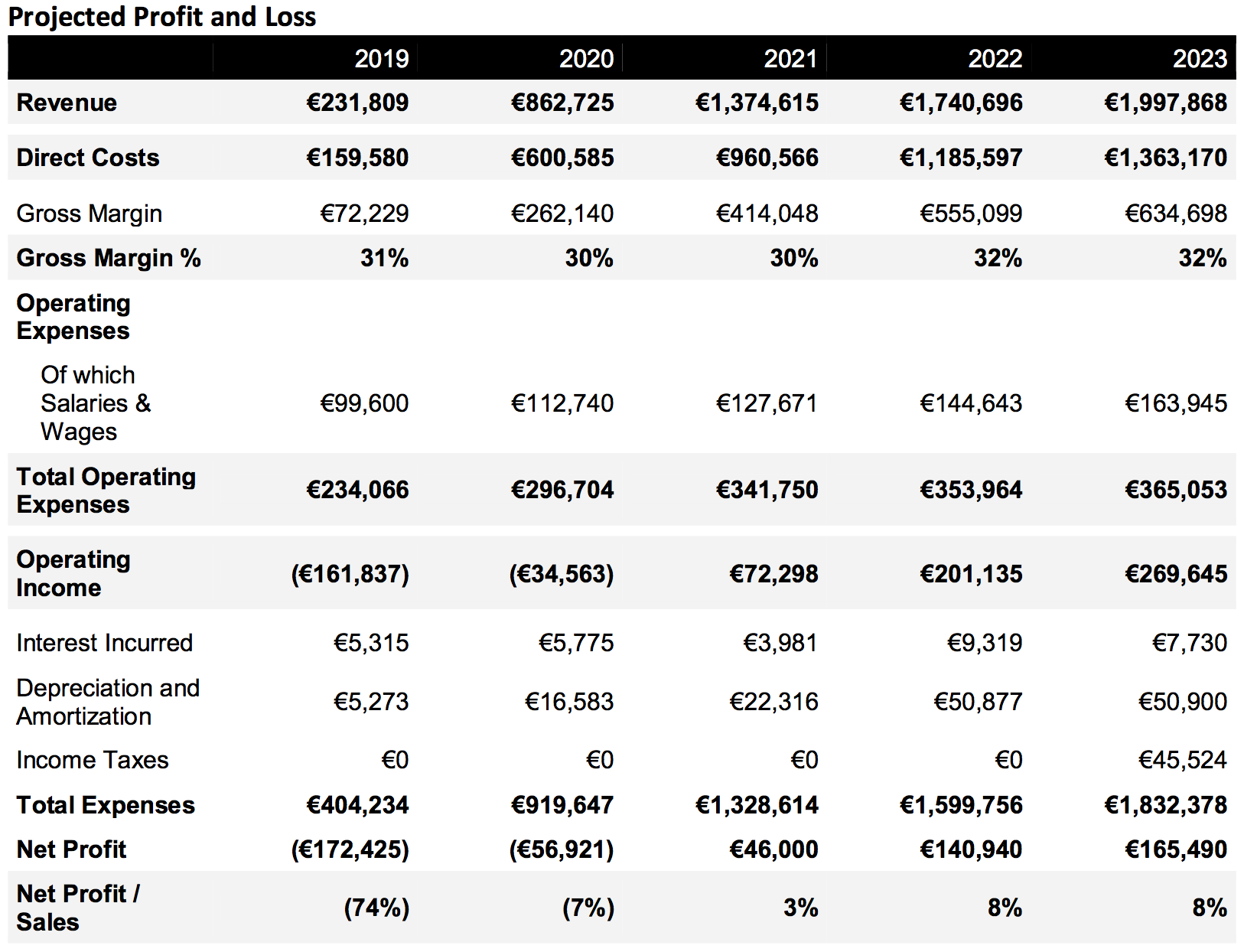

Financial plan

With the considered forecast ('Base case'), Cruso is producing an accounting loss in first and second year. The net result recovers in third year (+46 000 Eur) and fourth year (+140 940 Eur). Sales forecast are deemed conservative with regards to the number of countries being covered by the Cruso brand in 2021. Sales numbers can be much higher in some instance (eg. for specific countries or specific models).

For funding, our objectives is to partner with equity partners wishing to stay with the company over the medium term. We expect that attractive exit opportunity may materialize after 4 years of operations.The first two rounds of equity investments will provide the necessary funding for developing new products as well as the sales on an international scale, with at least 4 countries being covered within a year and 11 countries at 2020 end. This geographic coverage is deemed as totally realistic with the prospective reach of professional sales activities (trade fairs, direct contacts of sales agents, contact with distributors...).

Revenue drivers

As revenues drivers, we expect the larger, more costly pieces of furniture to drive the company profitability. Pieces like a new large sideboard or new sofa are expected to become new revenue making lines for Cruso. Please find an indicative list of new products being developed in the near future (by 2021) :

- Coffee table

- Mirors

- Lamps

- Sideboard

- Sofas

- Armchairs

- Chairs

- Kids furniture

- Other Accessories (rugs, trays,...)

We expect the first 12 months of sales activities to be a good indicator of the possible growth path for the brand. The sales forecasts have been compiled on a product level and by country basis. These provide insights over forecasted sales and main contributors to the turnover projections.

Cost drivers

Cost of sales is approximately 70% of revenues (incl. production / order fulfilment human resources costs). These costs are constant for the various products.

There are a number of expenses that have been variabilised such as transport & packaging where real costs quotes have been set with service providers. However, it is expected that in some instances cost of sales can be decreased, thereby improving the operational margin over the longer term. Most other costs can be considered as variable and we will limit general expenses and administration costs to a minimum, until sufficient sales traction is achieved.

There are some investments expected to be made in prototyping, tooling and in buying back design models that provided sufficient market traction.

There are a number of expenses that have been variabilised such as transport & packaging where real costs quotes have been set with service providers. However, it is expected that in some instances cost of sales can be decreased, thereby improving the operational margin over the longer term. Most other costs can be considered as variable and we will limit general expenses and administration costs to a minimum, until sufficient sales traction is achieved.

There are some investments expected to be made in prototyping, tooling and in buying back design models that provided sufficient market traction.

Human resources costs

In order to safeguard the company value while launching development plans, salaries have been capped for each employee & managers. Budgets for human resources presented here :

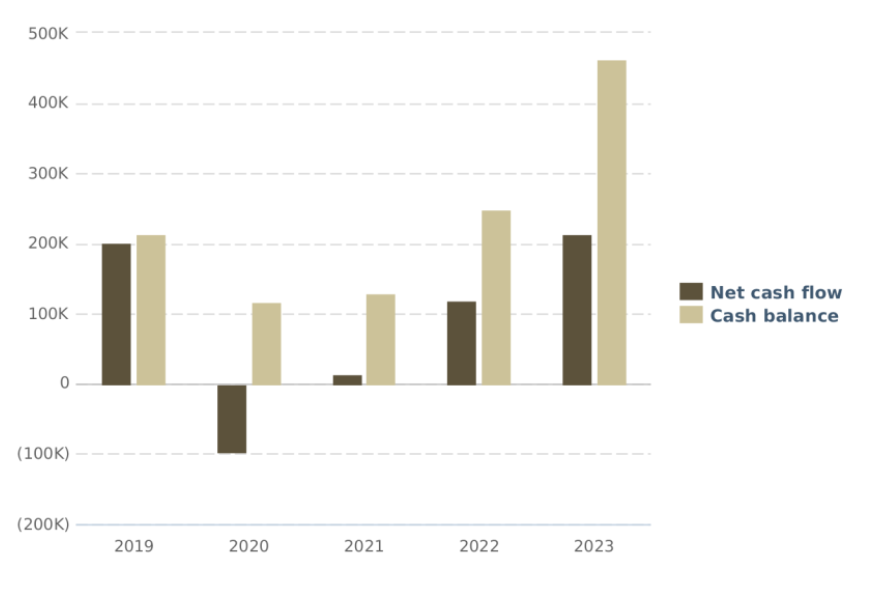

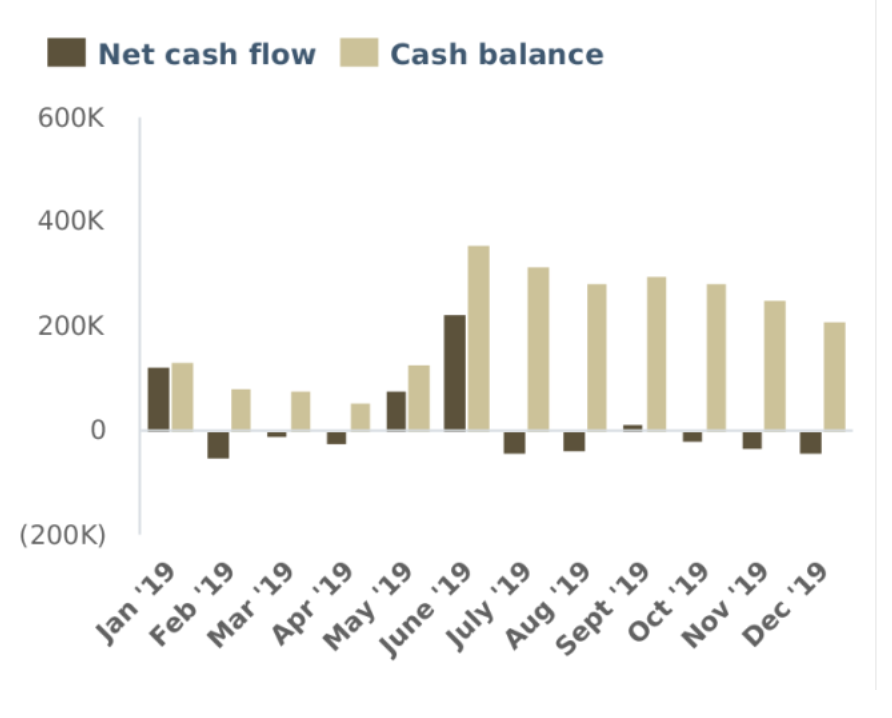

Financial tables

Net Profit (by year)

Cash flow (by year)

Cash Flow (by month)

Cash security : We aim to keep a sufficient cushion of cash available at all times (about EUR 100k). The burn rate will decrease overtime as quickly as 2020 as sales pickup. We aim to monitor the burn rate very closely. Taking in account the planned investments and new loans in 2019, lowest cash position expected being during 2020.

Break even volume

765 000 EUR of sales (excl. investments)