Spreds 2A

€4,750,001

total amount raised

- Backed by over 440 investors

This campaign has been closed

The following description is an extract from the Prospectus. For more information on the investment mentioned in this section, you are invited to carefully read the Prospectus, and in particular the risk factors described therein, before making any investment decisions.

Present situation

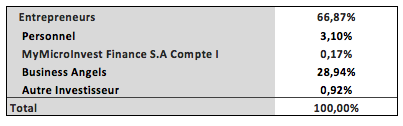

At present, the capital of MyMicroInvest amounts to 4,311,008.26 EUR, which is entirely paid in. It is represented by 17,250,001 shares distributed and allocated as follows:

The Entrepreneurs are the directors who perform management functions at MyMicroInvest. This group consists of:

- José Zurstrassen, co-founder, chairman of the board of directors;

- Olivier de Duve, co-founder, managing director;

- Charles-Albert de Radzitzky, co-founder, CFO and responsible for participations;

- Guillaume Desclée, co-founder, COO and responsible for marketing;

- Gilles Van der Meerschen, responsible for sales.

Among the Business Angels, there are also the directors of MyMicroInvest who do not exercise a management function at MyMicroInvest.

The MyMicroInvest Finance Account I is the fruit of a gratis allocation of MyMicroInvest Notes to the most loyal users of the MyMicroInvest.com platform.

Forecasted capital increase

The increase of capital in which MyMicroInvest Finance will participate is part of a broader financing of MyMicroInvest that is planned to be between 2,753,000 EUR and 5,753,000 EUR a part of which has already been achieved. This funding is allocated as follows:

- A contribution in kind in the amount of 753,000 EUR was made on 27 July 2015 by certain shareholders of MyMicroInvest consisting of the conversion of convertible bonds;

- A cash injection of 2,250,001 EUR was underwritten by an existing shareholder and three new business angel type investors at a pre-money valuation of 15 million EUR;

- Between a minimum of 500,000 EUR and a maximum of 1,750,000 EUR will be underwritten by MyMicroInvest Finance on the basis of the results of the Note issuance;

- Up to 2,250,000 EUR may be invested by other business angel type investors.

The value of MyMicroInvest shares, prior to the repurchase of the shares by MyMicroInvest Finance, has been set at a maximum of 17,250,001 EUR (including 2,250,001 EUR subscribed on 27 July 2015) by the shareholders of MyMicroInvest. It is susceptible to revision prior to the anticipated increase of capital but MyMicroInvest Finance will only perform the proposed investment if the valuation of the shares, before the capital increase, does not exceed 17,250,001 EUR (including 2,250,001 EUR subscribed on 27 July 2015).

The valuation was made on the occasion of the capital increase of 27 July 2015 with business angel type investors. This valuation was 15 million EUR before the capital increase (pre-money). Investors invested 2,250,001 EUR in this capital increase, bringing the current value at 17,250,001 EUR (post-money).

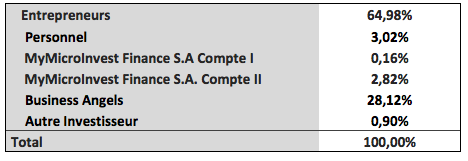

The table below indicates the distribution of the shares of the company following this capital increase on the basis of the assumption that the result of the issue of the Notes allows MyMicroInvest Finance to subscribe the attended minimum amount, of 500,000 EUR.

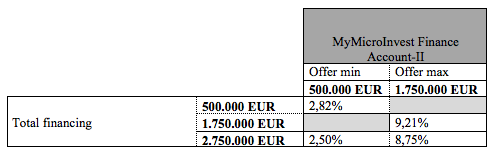

The table below indicates the percentage of equity held by the Account-II MyMicroInvest of MyMicroInvest Finance depending on the result of the present issue of Notes (minimum 500,000 EUR and maximum 1,750,000 EUR) and the maximum amount of 2,250,000 EUR to be subscribed by the others investors.

Financial instruments offered

MyMicroInvest operates a crowdfunding platform that enables the public to finance innovative companies by participating in their capitalisation. The investment offered, for a minimum amount of 100 EUR, comprises Notes issued under Belgian law which represent a claim against the issuer, MyMicroInvest Finance, a public limited company under Belgian law having its corporate headquarters at Rue de Wavre 27 in 1301 Bierges (n°5 38.839.354, R.P.M. Nivelles).

The total amount brought in at the end of the offer shall be used by MyMicroInvest Finance to subscribe to a capital increase in MyMicroInvest.

The Notes have an unlimited duration and are denominated in Euro. They do not offer any guaranty of yield or of reimbursement of capital. The interest and sum reimbursed depend entirely on the performance of the investment made via the proceeds of the Notes issue by MyMicroInvest.

The nominal value of the Notes corresponds to the sum of the subscription, including costs of the issue, but excluding the payment of expenses described below. The investment on offer does not carry any expense other than a possible payment expense of 1.85%. All the variable interest payable to the owners of the Notes, as well as the amount of reimbursement of the Notes which is greater than the nominal value of the Notes, shall be considered as interest, taxable, as a general rule, for private individuals who are Belgian residents through the 25% withholding tax at source.

It is necessary to read the attached Prospectus attentively before subscribing to the Notes, and in particular, to consider the risk factors that are described therein before making any decision on investment. We draw the attention of the potential investor to the fact that there is a risk that the goals of MyMicroInvest will not be reached, which might lead to a substantial reduction in the expected revenue and thus incur a risk of insolvency or at least of low yield, even zero or negative yield for the investors.

Any complaint relating to an investment in the Notes can be addressed to the headquarters of the issuer indicated above or to the Service de Médiation pour le Consommateur, Boulevard du Roi Albert II 8 - 1000 Brussels, tel.: 02/702.52.20, fax.: 02/808.71.29, email: contact@mediationconsommateur.be.

The Notes may be traded on the Brussels’ Euronext Expert Market with the ISIN code: BE6281678555.