Spreds 2A

€4,750,001

total amount raised in round

350%

- Backed by over 440 investors

Campaign Closed

Market positioning

The MyMicroInvest business model is simple and is based on 3 main activities:

(1) For the crowdfunding activity, MyMicroInvest achieves a turnover by selling a platform access package to entrepreneurs, then, in the event the campaign is successful and there is investment, MyMicroInvest also receives a management fee from the investors.

(2) Inventures equity management is a second source of revenue for MyMicroInvest. Effectively, Inventures’ investors pay an annual fee of 2% (maximum 6 years) for the management of their shareholdings.

(3) Speedfunding, putting investors interested in a direct investment in a company for amounts above 25,000 EUR into contact with said companies. MyMicroInvest is paid a sum of 6% in the event an entrepreneur and an investor agree to an investment.

(4) Other, more marginal activities can also be a source of revenue for MyMicroInvest (e.g. subsidies).

(1) For the crowdfunding activity, MyMicroInvest achieves a turnover by selling a platform access package to entrepreneurs, then, in the event the campaign is successful and there is investment, MyMicroInvest also receives a management fee from the investors.

(2) Inventures equity management is a second source of revenue for MyMicroInvest. Effectively, Inventures’ investors pay an annual fee of 2% (maximum 6 years) for the management of their shareholdings.

(3) Speedfunding, putting investors interested in a direct investment in a company for amounts above 25,000 EUR into contact with said companies. MyMicroInvest is paid a sum of 6% in the event an entrepreneur and an investor agree to an investment.

(4) Other, more marginal activities can also be a source of revenue for MyMicroInvest (e.g. subsidies).

Market trends

The crowdfunding market

The principle of crowdfunding is not new. In 1883, New Yorkers together financed the Statue of Liberty.

What is new is the crowdfunding term itself, and its development through specialised internet platforms. It was in 2008, in the midst of a full-blown economic crisis that made company and project financing extremely difficult (the famous credit crunch) that the crowdfunding market really took off.

Nowadays, crowdfunding is an integral part of project-financing sources. The specialised platforms are often found under the term “FinTech”, referring to innovative companies that use technology to revamp financial and banking services.

The market figures and trends provided below come in large part from the “2015CF Report” by Massolution. The figures for the Belgian market come from the “Crowdfunding in Belgium 2014” report, drafted by Douw&Koren.

What is new is the crowdfunding term itself, and its development through specialised internet platforms. It was in 2008, in the midst of a full-blown economic crisis that made company and project financing extremely difficult (the famous credit crunch) that the crowdfunding market really took off.

Nowadays, crowdfunding is an integral part of project-financing sources. The specialised platforms are often found under the term “FinTech”, referring to innovative companies that use technology to revamp financial and banking services.

The market figures and trends provided below come in large part from the “2015CF Report” by Massolution. The figures for the Belgian market come from the “Crowdfunding in Belgium 2014” report, drafted by Douw&Koren.

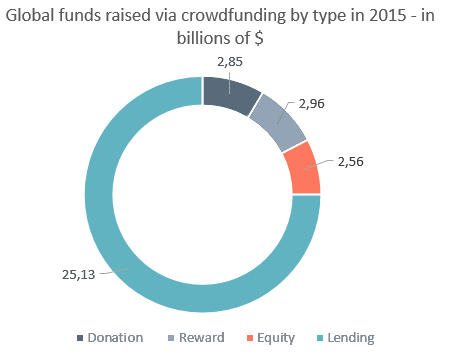

It is common practice to segment the crowdfunding market into 4 categories:

- Donation;

- Reward;

- Lending; and,

- Equity.

MyMicroInvest is active in two of these segments: lending-, and equity-based financing. To date, these activities are mainly in the Belgian market (even if foreign companies, such as Youscribe in France, have already raised funds on MyMicroInvest).

- Donation;

- Reward;

- Lending; and,

- Equity.

MyMicroInvest is active in two of these segments: lending-, and equity-based financing. To date, these activities are mainly in the Belgian market (even if foreign companies, such as Youscribe in France, have already raised funds on MyMicroInvest).

The chart below shows the global, projected scale of these four segments for 2015.

Source: Massolution 2015CF report

Development of the crowdfunding market

Growth by region

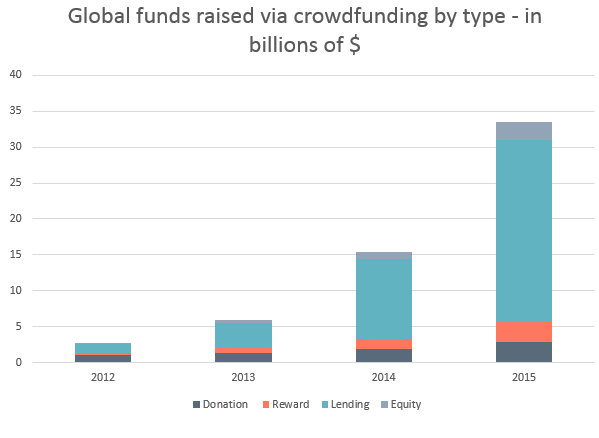

The global crowdfunding market has seen an impressive growth.

The global market should experience an annual increase of around 134% between 2012 and 2015.

The US market is the largest, followed by the Asian market - its large population increases the growth of the global market (the amounts raised quadrupled in 2014).

The global market should experience an annual increase of around 134% between 2012 and 2015.

The US market is the largest, followed by the Asian market - its large population increases the growth of the global market (the amounts raised quadrupled in 2014).

The European market has more than doubled and, in 2014, around 2.7 billion euros were raised on crowdfunding platforms (all categories combined).

More than two thirds of the crowdfunding financing took place in the United Kingdom, where the market is the most mature. The United Kingdom is followed by France, Germany, the Netherlands, and Spain.

More than two thirds of the crowdfunding financing took place in the United Kingdom, where the market is the most mature. The United Kingdom is followed by France, Germany, the Netherlands, and Spain.

Massolution projects that the European market will likewise double in 2015.

The Belgian market quadrupled in 2014, going from 1.1 million euros to 4.35 million euros raised on the platforms.

We expect a continuous and greater growth than the European average for the Belgian market, brought about by a greater public acceptance, in addition to tax measures such as tax shelters for start-ups, amongst others things.

By way of illustration, in 2014, each Belgian invested on average 0.40 EUR through crowdfunding, whilst the inhabitants of the Netherlands and the United Kingdom invested on average 3.70 EUR and 29.80 EUR respectively.

We expect a continuous and greater growth than the European average for the Belgian market, brought about by a greater public acceptance, in addition to tax measures such as tax shelters for start-ups, amongst others things.

By way of illustration, in 2014, each Belgian invested on average 0.40 EUR through crowdfunding, whilst the inhabitants of the Netherlands and the United Kingdom invested on average 3.70 EUR and 29.80 EUR respectively.

Growth by crowdfunding type

The growth of the four types of crowdfunding differs significantly. Loan-based financing experienced the strongest growth in 2014, followed by the growth in the equity crowdfunding category. Both tripled in 2014, whilst donation and reward saw a more moderate growth. The activities of MyMicroInvest consequently lie in the most attractive market segments and the growth should continue throughout 2015 and the following years.

The growth of the four types of crowdfunding differs significantly. Loan-based financing experienced the strongest growth in 2014, followed by the growth in the equity crowdfunding category. Both tripled in 2014, whilst donation and reward saw a more moderate growth. The activities of MyMicroInvest consequently lie in the most attractive market segments and the growth should continue throughout 2015 and the following years.

Source: Massolution 2015CF report

Market trends

To explain the above figures, some trends can be identified in the market:

- On a global scale, the crowdfunding market has not yet been consolidated. Nonetheless, the trend is different in the USA than in Europe: In the USA, a more mature market, the consolidation is stronger and the big platforms gain market share, whilst in Europe the fragmentation is still high;

- More and more platforms are becoming specialised in either the type of crowdfunding or the sector of the projects (health, environment, etc.);

- There is an increasing interest in investments with a social impact, especially amongst investors in the 25 to 50 age range, who most actively invest in crowdfunding projects;

- Crowdfunding isn’t only for start-ups. Some of the world’s biggest companies, such as Coca-Cola have also used crowdfunding. However this was more to gain knowledge about their customers rather than to raise funds.

Competition

The market growth is also reflected by the existence of other platforms.

The management of MyMicroInvest has identified several competing players within Belgium, and a brief description of their activities is provided below:

The management of MyMicroInvest has identified several competing players within Belgium, and a brief description of their activities is provided below:

- Look&Fin: Look&Fin is a crowdlending (loan finance) platform, primarily active in Belgium and France. It allows growing companies to organise fundraising from the crowd.

- Bolero Crowdfunding: Bolero is a company of the KBC Securities group. It was launched in March 2015 and provides funding opportunities with equity, loans or convertible loans.

- Kickstarter: Kickstarter is a US reward crowdfunding platform that entered the Belgian market and offers financing that provides a reward in return.

Other "capital" crowdfunding platforms are present in major European countries, such as France (Wiseed), the United Kingdom (Seedrs or Crowdcube), etc.

The MyMicroInvest structure, as explained in the “Idea” section, is the only one of its kind in Europe. This offers a strong competitive advantage for its deployment in Europe.

The MyMicroInvest structure, as explained in the “Idea” section, is the only one of its kind in Europe. This offers a strong competitive advantage for its deployment in Europe.