Cole Pharmaceuticals 1A

Improving peoples' lives by redefining Vitamin D treatments

€438,400

total amount raised in round

377%

- Backed by over 140 investors

- Eligible for a tax reduction

Campaign Closed

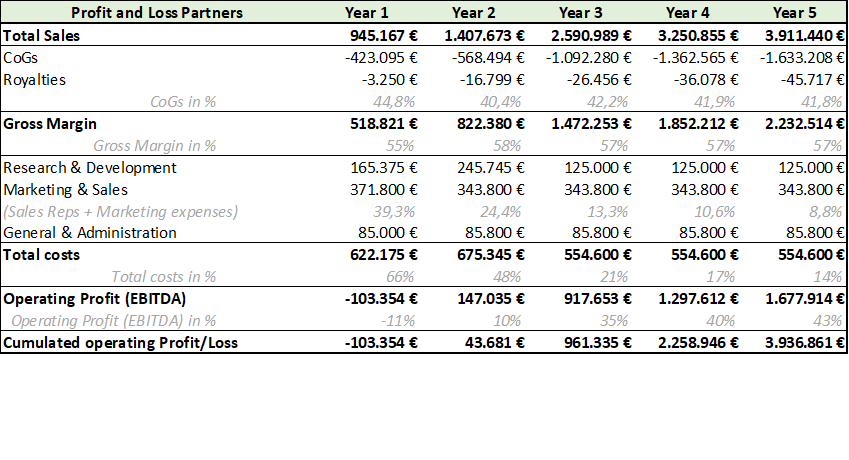

Revenue drivers: The revenue estimates are based on Cole Pharma current sales funnel with international partners and a direct presence on the Belgium territory. Cole Pharma’s product margins vary between 46% up to north of 60% and prices were determined based on a double analysis of cost of goods (CoGs) and market prices which were reconciled. For the first three years, sales to partners start with vitamin D food supplements. The launch of drugs starts mid-year 3 onwards. The IRR is over 50%. It is related on valuing the company based on sales.

Cost drivers: In addition to the cost of outsourced production (CoGs), the other costs will be the marketing and sales costs related to marketing the products in Belgium and supporting partners abroad. The second cost item is R&D, which covers regulatory affairs and new product development. G&As are costs related to support functions and services such as legal fees, insurance, travel and rent office.

Cost drivers: In addition to the cost of outsourced production (CoGs), the other costs will be the marketing and sales costs related to marketing the products in Belgium and supporting partners abroad. The second cost item is R&D, which covers regulatory affairs and new product development. G&As are costs related to support functions and services such as legal fees, insurance, travel and rent office.

Please note that at present the Company has losses to an extent that its net assets have dropped to less than half of its equity or lower than the legal minimum as per the applicable laws (alarmbell procedure). However, this is not uncommon for young companies.