Herculean 1A

The sportainment and corporate wellbeing platform

€460,300

total amount raised in round

126%

- Backed by over 120 investors

Campaign Closed

1. Existing shareholders

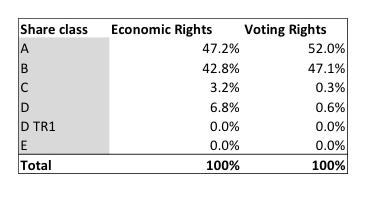

First and foremost, it must be noted that Herculean is a cooperative limited liability company under Belgian Law, this means that the capital of the company consists of two distinct parts: the fixed capital and the variable capital. To this end, different share classes exist, with different share prices and different voting rights. The table below summarises the different share classes and provides the most important information:

Before the capital increase in which MyMIcroInvest Finance will participate at the end of the offer, the entrepreneurs of Herculean jointly hold 52% of the voting rights of the company, solely in the fixed part of the capital, while the external investors hold jointly 48% of the voting rights.

Shares classes D TR1 and E will be created during the current capital increase. MyMicroInvest Finance will subscribe to shares of class E. Shares of class E will be attributed a liquidation preference: in case of a liquidation or a sale of the Company, a transfer of all or almost all the assets or shares of the Company or any other operation having a similar outcome, MyMicroInvest Finance will benefit from a preferential right guaranteed annual return of 3% per year of the whole period of its investment on the proceeds resulting of the exit event.

Once a year, at the anniversary of the investment of MyMicroInvest Finance, MyMicroInvest Finance may organise a liquidity event in order to give the Noteholders the opportunity to ask for a “terugneming” of the underlying shares to Herculean CVBA at the price defined in Article 10 of the article of association of the Company. Based on this, MyMicroInvest Finance will exercise its right to ask for the “terugneming” of (part) of its shares according to Article 10 of the Company’s articles of association. For the first three year following the Investment of MyMicroInvest Finance in the Company, MyMicroInvest Finance will limit the total share buyback to maximum 10% of its participation.

2. Forecasted capital increase

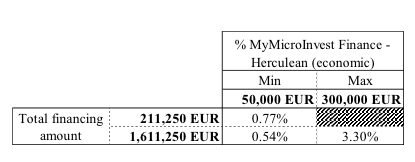

The capital increase to which MyMicroInvest Finance will participate is part of a broader funding of Herculean considered to be between 211,250 EUR and 1,611,250 EUR.

This funding will be allocated as follow :

- Between minimum 50,000 EUR and maximum 300,000 EUR will be subscribed by MyMicroInvest Finance based on the results of the issuing of the Notes ;

- A minimum of 50,000 EUR and a maximum of 1,200,000 EUR will be invested by other investors, i.e business angels.

- An investor of class B will convert a convertible loan to equity for an amount of 111,250 EUR.

As different share prices exist, there is no single and unique pre- and post-money valuations. The investment by each category of shareholders will influence the percentage detained in Herculean by each investor after the planned capital increase.

In case of attaining the maximum financing amount, the base case scenario is the following:

Based on the above-mentioned assumptions, the post-money valuation of the E-shares will be 7,839,054 EUR.

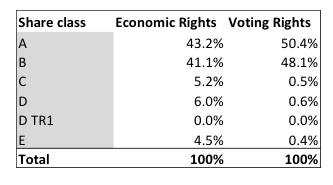

The table below indicates the distribution of the shares of the company following this capital increase on the basis of the following assumptions:

- MyMicroInvest Finance will subscribe the maximum amount of 300,000 EUR;

- The other investors, will subscribe the minimum amount that is allotted to them, i.e. 50,000 EUR, assuming that the other investors are all receiving class A shares, being the most conservative scenario for MyMicroInvest Finance.

- An investor of class B converting a convertible loan to equity for an amount of 111,250 EUR.

The table below presents the percentages of the capital held by the Herculean account of MyMicroInvest Finance depending on the results of the Notes issue (i.e., a minimum of 50,000 EUR and maximum of 300,000 EUR) and the minimum and maximum amounts contributed by the other investors including the convertible loan (i.e., a minimum of 161,250 EUR and a maximum of 1,311,250 EUR), assuming that the other investors are all receiving class A shares, being the most conservative scenario for MyMicroInvest Finance.