WeGroup 1A

A new way to protect your home

€140,288

total amount raised in round

181%

- Backed by over 100 investors

- Eligible for a tax reduction

Campaign Closed

1. Existing shareholders

Before the capital increase in which Spreds Finance will participate at the end of the offer, the entrepreneurs of WeGroup jointly hold 80% of the shares of the company. The other 20% is allocated to 2 invaluable members of WeGroup's initial Advisory Board, who have now joined their Board of Directors.

2. Forecasted capital increase

The capital increase to which Spreds Finance will participate is part of a broader funding of WeGroup considered between €200,000 and €500,000. The funding will be allocated as follows:

- Spreds Finance will subscribe between €50,000 and €99,900 based on the results of the issuing notes.

- A minimum of 100,100 EUR and a maximum of 450,000 EUR will be invested by other investors, i.e business angels. A private, strategic investor will invest between €150,000 and 200,000. This is 'smart money', as the investor has great complementarity with WeGroup and envisions the same future.

The value of the company before this increase in capital is presently estimated to be a maximum of 900,000 EUR. Following this increase in capital, the value of the company will be between 1,100,000 EUR and 1,400,000 EUR, meaning an estimated valuation of 900,000 EUR before increase of capital plus between 200,000 EUR and 500,000 EUR of new money brought in.

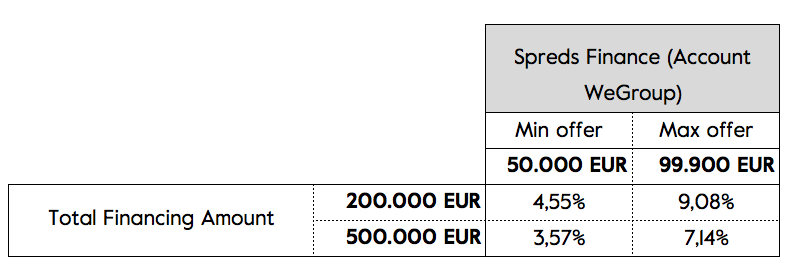

The table below presents the percentages of the capital held by the WeGroup account of Spreds Finance depending on the results of the Notes issue (i.e., a minimum of 50,000 EUR and maximum of 99,900 EUR) and the minimum and maximum amounts contributed by the other investors (i.e., a minimum of 100,100 EUR and a maximum of 450,000 EUR).

The table below presents the percentages of the capital held by the WeGroup account of Spreds Finance depending on the results of the Notes issue (i.e., a minimum of 50,000 EUR and maximum of 99,900 EUR) and the minimum and maximum amounts contributed by the other investors (i.e., a minimum of 100,100 EUR and a maximum of 450,000 EUR).

III. Extra Information

- A private, strategic investor will invest between €150,000 and 200,000. This is 'smart money', as the investor has great complementarity with WeGroup and envisions the same future.

- After the capital increase, we will acquire between €400,000 and €600,000 in debt.

- Half of this amount will be provided by the PMV KMO-cofinancing program in the form of a subordinated loan with a payback on 6 years.

- The other half will be provided by our banking partner in the form of a 5-year straight loan..