WeGroup 1B

€99,988

total amount raised in round

100%

- Eligible for a tax reduction

Campaign Closed

DISCLAIMER

Every investment decision must be based on an examination of an exhaustive set of information provided by the entrepreneur on their online profile. Spreds only proceeds to a limited verification of this information and does not control the investment opportunity within this company. Spreds did not verify the extent to which the business plan is deemed realistic and does not intervene in determining the final terms of the investment, including the retained maximum valuation. Spreds will align itself with the financial terms negotiated with the co-investor(s).

Description

Note: Only 114,700 € are subjected to the Startup Tax Shelter regime. Once this amount is exhausted, the frame below will no longer be displayed (after Payment Method). Feel free to contact Spreds to find out how much money Tax Shelter is still available.

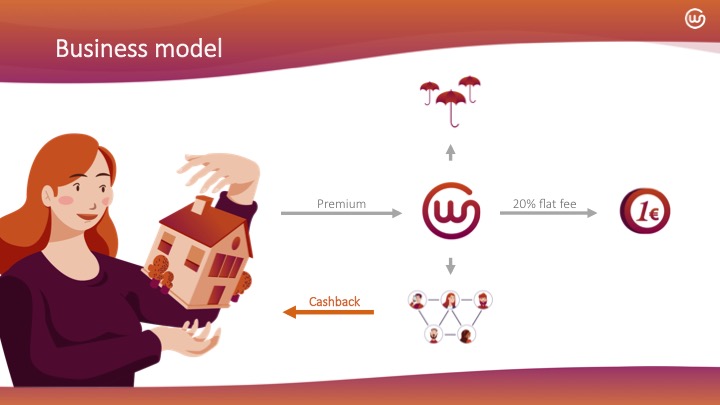

WeGroup offers an alternative to traditional insurance with its combination of an innovative business model and cutting-edge technology.

At WeGroup, users are part of small groups within our community in order to share a part of the insured risk with their peers. This way, a large part of the premium can be returned each year if users remain free of claims. We stimulate this positive behavior even further by awarding WeCoins for preventive matters (such as installing a smoke detector or burglary alarm) as well as sharing data or inviting friends to their Group. All actions (underwriting a policy, managing a claim etc.) are done in realtime with the help of our robo-broker ‘Louise’, with unseen speed and high-end user experience.

There is no doubt about it: WeGroup #insures the Future.

Problem

General

Today, everything is digital; people order headphones via Amazon, switch foodbag providers and wire money via simple mobile transactions. This is a trend that will only continue. You can monitor your house or car from anywhere, quickly check up on your body vitals while your fridge is ordering a new milk carton.

This is no longer sciencefiction. Companies are doing everything within their power to get to know their customers and offer personalised services. Nevertheless, some industries have lingered in the past. Digital natives today are confronted with a way of insuring that no longer strokes with their lifestyle. They alienate from their broker or insurer, because they no longer speak the same language.

We believe there are 2 main problems with insurance today:

This is no longer sciencefiction. Companies are doing everything within their power to get to know their customers and offer personalised services. Nevertheless, some industries have lingered in the past. Digital natives today are confronted with a way of insuring that no longer strokes with their lifestyle. They alienate from their broker or insurer, because they no longer speak the same language.

We believe there are 2 main problems with insurance today:

Conflict of interest

Insurance is about calculating risk. Making accurate estimations guarantees financial benefits for the risk carrier, since low claims frequency and cost results in underwriting profit. It is in this theorem that the conflict of interest between the insurance company and the insureds finds its origin. Opposed to the carrier’s interest lie that of the customer. He pays a premium to be covered against the economic outcome whenever the insured risk occurs. It’s evidently in the insured’s interest to be indemnified for the suffered loss, perhaps even a little a more. The above has several consequences:

- Insurance becomes less accessible due to a tight acceptance policy

- A claims management culture with focus on denying claims

- The policyholder may be tempted to issue fraudulent claims

Inefficiency and high costs

One of the biggest sources of customer frustration are administrative procedures. Whether it’s about underwriting a policy, filing a claim, or simply adjusting personal data, every process is very time-consuming. The above can be attributed to ponderous business structures and processes. Furthermore, it leads to slow decision-making. This makes the company vulnerable to external changes, limiting its capabilities to innovate or rethink strategies and operations. These challenges cause loss of various resources for the insurance company. Like most of the time, high overhead costs are ultimately translated into a high premiums.

Idea

WeGroup offers an alternative for classic insurance through a digital community platform, focussing on a win-win situation for all parties involved. Our solution is dual, since we acknowledge two major categories from which the challenges stated above arise. The conflict of interest is clearly an insurance-technical issue, which can be solved by rethinking the traditional business model. Difficulties posed by inefficiency, resulting in frustration and high costs, is of a rather technical nature and should be dealt with in a technological way.

Peer-to-peer insurance

Technology

Technological innovation is crucial to our product and service. We aspire to achieve a high degree of digitalization and automation, with a focus on efficiency and an optimal user experience. We embodied this vision in Louise, who puts her artificial brain to good use, using extensive customer data analysis to solve claims in real-time, improves underwriting calculations and offers better advice to customers. Naturally, Louise is fully compliant with GDPR regulations.

Marketing strategy

WeGroup’s primary marketing/communication channel is Facebook (and Instagram in addition), since the core of our target group is using this as main social network. Through daily posts and advertisement we lead potential users to small landingspages or blog/vlog posts with the final goal of getting them into a conversation with our robo-advisor Louise.

Next to this, we also belief that traditional, offline methods such as personalized mail advertisement in combination with guerilla marketing tactics.

Distribution strategy

WeGroup distributres its products in different ways. The main line of distribution is direct sales online. Potential users have a short conversation with Louise to determine insurance needs and risks, and can instantly buy a policy after receiving a custom quote.

However, if people do prefer a physical agent, they can underwrite the product and be linked to one of our distribution partners, who by themselves, sell our products in a traditional way (for an additional fee).

Internationalisation strategy

WeGroup looks beyond the Belgian borders and is omnipresent at International FinTech and InsurTech conferences and events, pitching our vision to insurance players all over the world. Our founders are frequently invited as keynote speakers or thought leaders on various topics regarding the insurance industry. WeGroup also has an office in London, the European capital for FinTech, via our accelerator Cepphar.

Intellectual Property

Our technology is fully software driven, but the main value of the platform is the collected and processed data. This is why all focus goes towards protecting the data and underlying algorithms. Given the complexity and limited effectivity of patenting software, no effort is made in this domain thus far.

Major contracts

WeGroup has four pending proof-of-concept deals, two of which are in final, signing phase. All deals involve a significant revenue stream of 50.000 to 200.000 EUR. Furthermore, these deals will grant WeGroup access to ten thousands of insurance claim cases and data. The value of this data for the training of our platform is priceless.

Furthermore, we agreed on a distribution partnership with the insurance broker network Grust, which involves, among other benefits, a minimum commitment of 1.000 insurance policies per year.

Furthermore, we agreed on a distribution partnership with the insurance broker network Grust, which involves, among other benefits, a minimum commitment of 1.000 insurance policies per year.

Main partners

We have two types of insurance partners. On the hand, we have partnerships with risk carriers such as PNP ('P&V Groep') and Lloyds Insurance Brokers. On the other hand, we have a distribution partnership with the insurance broker network Grust.

Furthermore, we have partnerships with the following institutions and organisations:

Furthermore, we have partnerships with the following institutions and organisations: