ParcApp 1B

€90,400

total amount raised

- Eligible for a tax reduction

This campaign has been closed

I. Acutal shareholders

Before the capital increase in which Spreds Finance will participate at the end of the offer, the entrepreneurs of Parclife BVBA/SPRL jointly hold 80% of the shares of the company while the external investors hold jointly 20% of the shares.

II. Forecasted Capital Increase

The capital increase to which Spreds Finance will participate is part of a broader funding of Parclife (Parcapp) considered between 125,000 EUR and 250,000 EUR. This funding will be allocated as follow :

- Between minimum 25,000 EUR and maximum 100,000 EUR will be subscribed by Spreds Finance based on the results of the issuing Notes ;

- Another campaign is running on Spreds for which more than 90,000 EUR have been raised until now (https://www.spreds.com/fr/financings/4054-parclife) ;

- The rest will be invested by other investors, i.e business angels (with a minimum of 50,000 EUR).

The value of the company before this increase in capital is presently estimated to be a maximum of 950,000 EUR. Following this increase in capital, the value of the company will be between 1,075,000 EUR and 1,200,000 EUR, meaning an estimated valuation of 950,000 EUR before increase of capital plus between 125,000 EUR and 250,000 EUR of new money brought in.

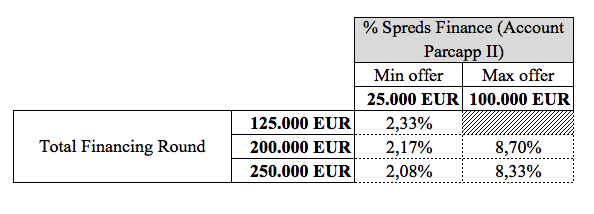

The table below presents the percentages of the capital held by the Parcapp II account of Spreds Finance depending on the results of the Notes issue (i.e., a minimum of 25,000 EUR and maximum of 100,000 EUR).

- Between minimum 25,000 EUR and maximum 100,000 EUR will be subscribed by Spreds Finance based on the results of the issuing Notes ;

- Another campaign is running on Spreds for which more than 90,000 EUR have been raised until now (https://www.spreds.com/fr/financings/4054-parclife) ;

- The rest will be invested by other investors, i.e business angels (with a minimum of 50,000 EUR).

The value of the company before this increase in capital is presently estimated to be a maximum of 950,000 EUR. Following this increase in capital, the value of the company will be between 1,075,000 EUR and 1,200,000 EUR, meaning an estimated valuation of 950,000 EUR before increase of capital plus between 125,000 EUR and 250,000 EUR of new money brought in.

The table below presents the percentages of the capital held by the Parcapp II account of Spreds Finance depending on the results of the Notes issue (i.e., a minimum of 25,000 EUR and maximum of 100,000 EUR).

It is to be noted that the entrepreneurs foresee to issue dilutive instruments (a convertible loan), but only to the extent that the shares distributed account for a maximum of 10% of the share capital of Parclife (Parcapp) to date.