TwinnTax 1A

Your tax assistant

€175,000

total amount raised in round

240%

- Backed by over 100 investors

- Eligible for a tax reduction

Campaign Closed

Financial Plan

The Financial Plan forecasts the next 3 years. TwinnTax takes into account Belgium and France only.

4 sources of revenue

TwinnTax innovates by creating an efficient software ... but will change the game thanks to its unique business model. The company's main revenues come from generating B2B opportunities.

As a result, TwinnTax will be free for targeted users. This is the fastest way to acquire a lot of users !

As a result, TwinnTax will be free for targeted users. This is the fastest way to acquire a lot of users !

- Revenues from paid widgets in app

- Revenues from annual plans, including real accountant service

- Revenues from advertising / cross sales

- Revenues from platform commission (not discussed at this stage)

Revenues from paid widgets

Basic app is free. People with a simple situation, or situation that has not changed since last year, can use the app for free.

However, for specific questions, such as house properties, TwinnTax created widgets to help people fill their forms with simple questions only. Those widgets cost 4,99€ per use.

However, for specific questions, such as house properties, TwinnTax created widgets to help people fill their forms with simple questions only. Those widgets cost 4,99€ per use.

Revenues from annual plans

TwinnTax offers 2 annual plans:

a) PREMIUM PLAN: 29,99€/year

Includes infinite widgets use, keeps data from one year to another

b) GOLD PLAN: 99,99€/year

Includes infinite widgets use, keeps data from one year to another, 30 min Skype meeting per year with a real accountant.

a) PREMIUM PLAN: 29,99€/year

Includes infinite widgets use, keeps data from one year to another

b) GOLD PLAN: 99,99€/year

Includes infinite widgets use, keeps data from one year to another, 30 min Skype meeting per year with a real accountant.

Revenues from advertising / cross selling

That's a big market, with comfortable margins.

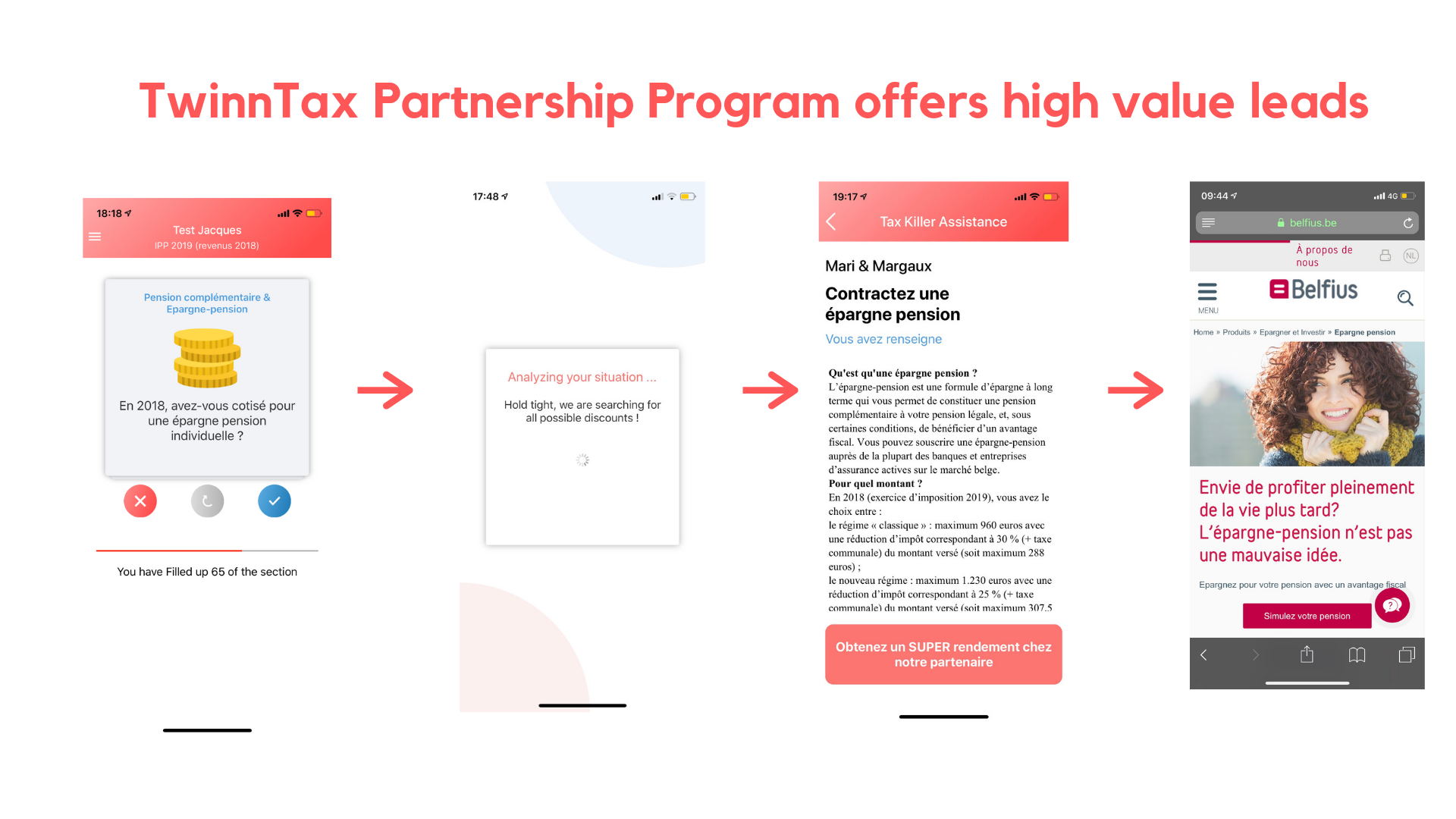

Here is an example of partnerships with a bank:

Here is an example of partnerships with a bank:

- First, the software analyses current tax return and detects if the client has no deductible pension plan (or unoptimized one, or competitor's one, ...)

- Second, TwinnTax shows him exactly how much he has "lost" and suggests to take action for next year

- Third, TwinnTax offers him to receive an offer from its partners

- Forth, TwinnTax sells that lead to its partner

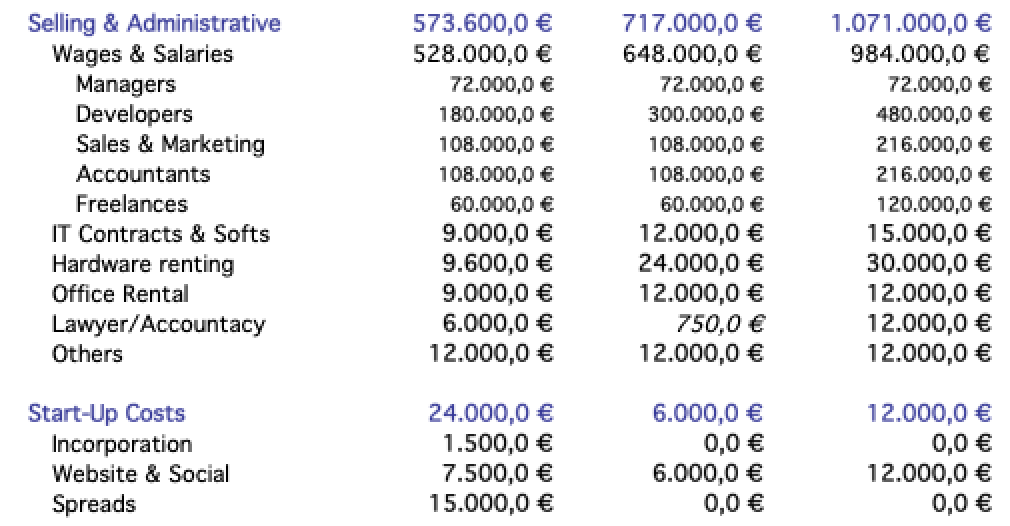

Costs description

The company fixed costs structure is easy to understand.

90% of TwinnTax costs is wages & salaries. Y1 : 528k€ ; Y2 : 648k€ ; Y3 : 984k€

As TwinnTax wants to focus most of its time on R&D, it plans to rent most of its hardware and offices materials.

90% of TwinnTax costs is wages & salaries. Y1 : 528k€ ; Y2 : 648k€ ; Y3 : 984k€

As TwinnTax wants to focus most of its time on R&D, it plans to rent most of its hardware and offices materials.

CPA discussion

Cost per acquisition (CPA) is very low for many reasons to be discussed.

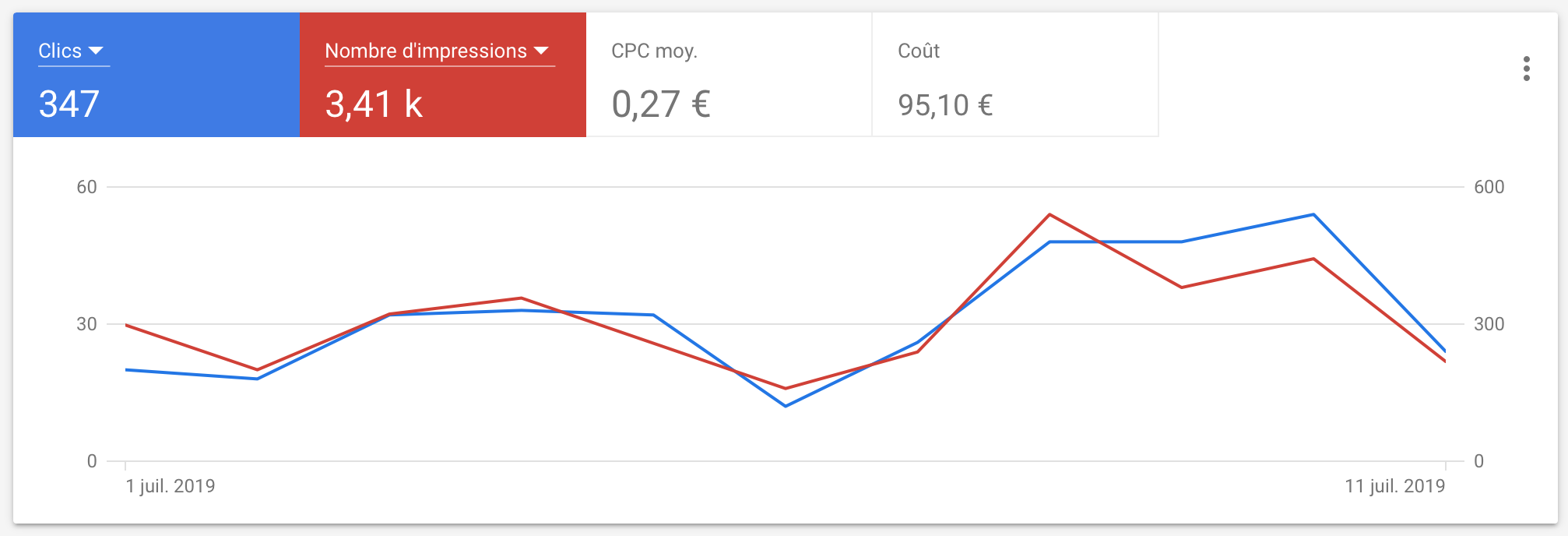

With Google AdWords, on a 10 days testing period.

With Google AdWords, on a 10 days testing period.

CTR > 10%

Cost per click = 0,27€. There are NO competitors bidding for those keywords.

46 people out of 347 registered to download TwinnTax. As a consequence, TwinnTax spent 2€/new user on google. Now have a look on Facebook :

Cost per click = 0,27€. There are NO competitors bidding for those keywords.

46 people out of 347 registered to download TwinnTax. As a consequence, TwinnTax spent 2€/new user on google. Now have a look on Facebook :

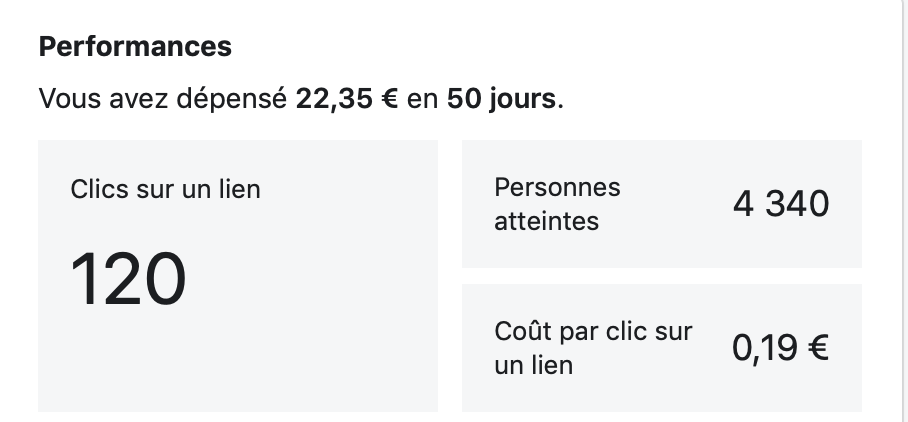

TwinnTax has got around the same numbers!

There are 3 reasons why attraction can be very high, leading in a low CPA:

There are 3 reasons why attraction can be very high, leading in a low CPA:

- High seasonality in Belgium. Unfortunately TwinnTax won't have much attraction in January... but it knows it! Marketing expenses will be engaged at the right time, enhancing its effectiveness.

- High "enthusiasm" for TwinnTax app. Who does not want a tip to reduce taxes ??

- If TwinnTax gave you the right advice and reduces your taxes by 300€, would you tell a friend ?

Hypothesis discussion

TwinnTax financial plan, including only one feature and 2 countries, shows very strong revenues, and here is why:

BE & FR Market = 30M users

After 3 years : 5% of will use TwinnTax = 1,5M users

After 3 years : 1% of will pay TwinnTax services = 300.000 paid customers

This would generate 1.4M€ gross revenues per month

Another way to evaluate TwinnTax potential income is to have a look at its Break Even Point.

TwinnTax needs a team of 10 people to manage BE & FR Market. Its fixed costs are 60k€/month.

To break even ( = generates 60k€/month revenues), TwinnTax need 170.000 users (34.000 paid customers).

BE & FR Market = 30M users

After 3 years : 5% of will use TwinnTax = 1,5M users

After 3 years : 1% of will pay TwinnTax services = 300.000 paid customers

This would generate 1.4M€ gross revenues per month

Another way to evaluate TwinnTax potential income is to have a look at its Break Even Point.

TwinnTax needs a team of 10 people to manage BE & FR Market. Its fixed costs are 60k€/month.

To break even ( = generates 60k€/month revenues), TwinnTax need 170.000 users (34.000 paid customers).