Spreds 2A

€4,750,001

total amount raised in round

- Backed by over 440 investors

This campaign has been closed

Historical accounts

The following description is taken from the Prospectus. For more information on investment mentioned in this section, you are invited to read the Prospectus, in particular the risk factors described therein, before making any investment decision.

MyMicroInvest closed its latest Financial Year on 31 December 2014. The financial accounts were approved by the general assembly on 24 June 2015 and published on 3 August 2015. The financial statements are presented below.

The numbers presented below are expressed in EUR.

MyMicroInvest has not established consolidated accounts at group level in accordance with article 112 of the Companies Code since it constitutes a small group as defined in Article 16 of the Companies Code.

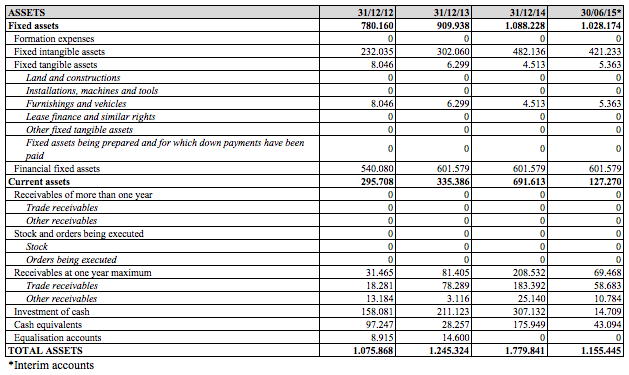

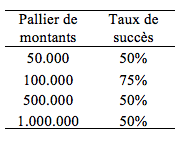

Balance sheet

Intangible assets represent the research and development activity mainly provided by part of the active employees. The financial assets represent investments in the companies MyMicroInvest Finance SA and Inventures SA. Treasuries investments and available currencies represent available cash.

Financial liabilities consist of a bank loan with ING Bank initially at 250,000 EUR for a residual amount of 195,303 EUR. The other debts correspond to a convertible bond of shareholders of which 753,000 EUR was converted into capital on 27 July 2015 and the balance repaid to shareholders.

The attention of the investor is drawn to the fact that the accounting situation that appeared on 30 June 2015 has since been heavily impacted due to:

(1) capital increases on 27 July 2015, the first consisting of a contribution in cash in the amount of 2,250,001 EUR and the second consisting of a contribution in kind resulting from the conversion of a loan worth 753,000 EUR and

(2) from the fact that MyMicroInvest on 12 October 2015 entered into a convertible loan in the amount of 1,000,000 EUR.

The attention of the investor is drawn to the fact that the accounting situation that appeared on 30 June 2015 has since been heavily impacted due to:

(1) capital increases on 27 July 2015, the first consisting of a contribution in cash in the amount of 2,250,001 EUR and the second consisting of a contribution in kind resulting from the conversion of a loan worth 753,000 EUR and

(2) from the fact that MyMicroInvest on 12 October 2015 entered into a convertible loan in the amount of 1,000,000 EUR.

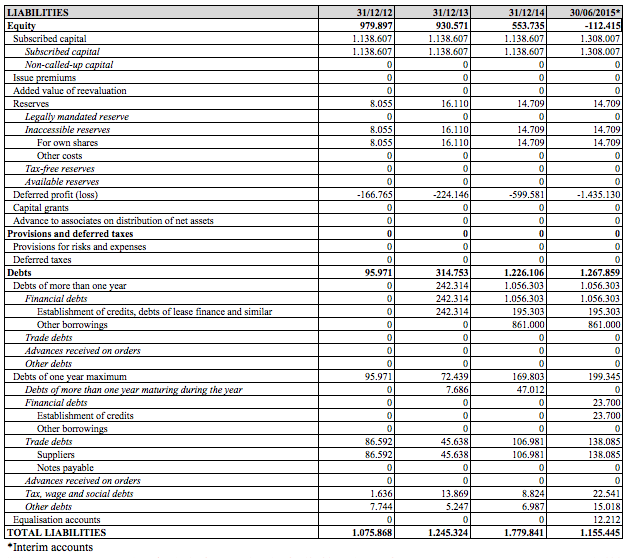

Income statement

The turnover of MyMicroInvest primarily comes from management fees levied on MyMicroInvest Finance SA and Inventures SA. It should be noted that in the interim financial statements of 30 June 2015, MyMicroInvest had not yet billed MyMicroInvest Finance for the whole of its compensation, which is provided for in the administration agreement between MyMicroInvest SA and MyMicroInvest Finance SA.

A portion of this revenue also comes from entrepreneurs who raise funds on the www.mymicroinvest.com platform managed by MyMicroInvest SA. The supplies, goods, services and divers assets represent various expenditure on rent, office supplies, legal fees, and other staff services. On 30 June 2015, there was a significant increase in "salaries, expenses, pensions and social costs" due to the fact that new employees were hired.

Financial plan

The entrepreneurs of MyMicroinvest have developed a financial plan that is built around four main operations of MyMicroInvest:

- Crowdfunding activities;

- The activities as the managing director of Inventures;

- The speedfunding events;

- Other activities.

For all of these activities, MyMicroInvest has based its assumptions on the experience gained in the early years of its operations and the development and growth observed over these years until today.

Revenue drivers

The revenue forecasts for each of these activities are described below in the following order: (1) volume assumptions; (2) price projections and, finally, (3) revenue assumptions of the business activity.

A. Crowdfunding activity

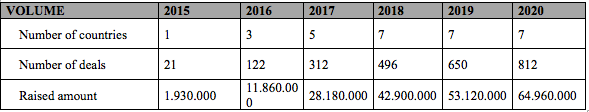

Volume assumptions

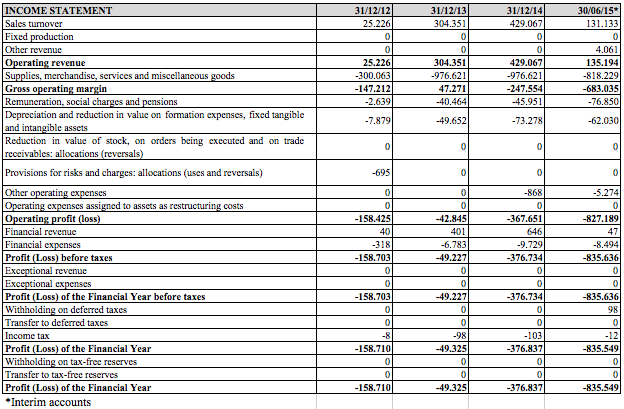

MyMicroInvest has prepared its projections in terms of volume based on the number of deals signed per month for the launch of the crowdfunding campaigns in Belgium. It has estimated based on the current situation that for the coming years there should be 3-4 deals signed per week. It has established a success ratio for each tier of the amounts to be raised, it being understood that a deal is successful when MyMicroInvest Finance has invested the raised amount into the company.

MyMicroInvest has evaluated, based on its experience, the monthly amounts raised with the average crowd for all of the successful deals. It is noted that for the last three months (including a month of August), it recorded an average of 199,000 EUR raised per month. MyMicroInvest then projected those results as an average for other European countries, a total of six additional countries in which it intends to establish itself in accordance with the internationalisation strategy that has been developed.

Price pojections

MyMicroInvest has categorised the deals according to the distribution between different types of financing transactions (capital or loan), and the distribution between the different selected packages (since all have an effect on price and income).

The price for a crowdfunding campaign, paid by MyMicroInvest Finance to MyMicroInvest for its managing director services, is based on several fees:

- The fees to launch the campaign, borne by the entrepreneurs, which depend on the package chosen by the company and which range from 1,495 EUR to 9,995 EUR (average 6,500 EUR);

- Only if a campaign is successful, the crowdfunding costs which vary according to the transaction:

- For a capital transaction, 12% of the amount subscribed by an investor is taken at the expense of the investor. As part of this transaction, such a commission will not be charged.

- For a loan transaction, the entrepreneur must pay 4% of the amount raised as a placement fee and then 1% per year for a paying agent fee over the term of the loan.

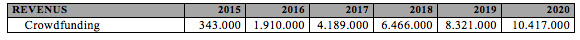

Revenue

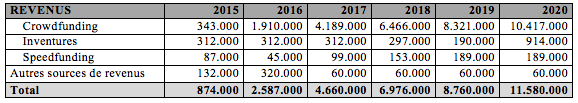

Revenues are the results of the above assumptions. The figures below are in euros.

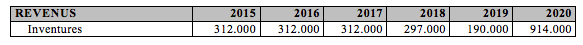

B. Activity as the managing director of Inventures

Volume projections

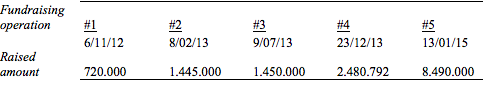

The Inventures SA shareholders have entrusted the management of funds to MyMicroInvest. The total amount of these funds is 14,647,792 EUR and is the result of several fundraising operations. The figures below are in euros.

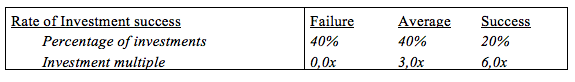

This amount raised has for the moment been invested in 9 companies for a total amount of 3,561,204 EUR and the rest could still be invested until December 2015 (with the possibility of extension). The financial plan includes the following success rates for these investments:

Price projections

The shareholders of Inventures pay MyMicroInvest by way of compensation for the management of funds an amount equal to 2% per year for 6 years on each anniversary date of the fundraising in which they participated.

If the investment is successful, MyMicroInvest is also entitled to a carried interest in the sense that in the event of a return of over 10% per year during the liquidation of Inventures, 20% of the capital gain exceeding the 10% will be paid to MyMicroInvest. If the annual return is between a cumulative annual return of 10% and a cumulative annual return of 12.5%, the difference between the capital gain realised and that corresponding to a cumulative annual return of 10% is fully paid to MyMicroInvest Finance (the "catch-up” mechanism). In the event of a cumulative annual return greater than 12.5%, 20% of the realised capital gain is deducted by MyMicroInvest Finance, the remaining 80% being payable to the Inventures shareholders. Only 35% of the carried interest could actually be received by MyMicroInvest SA on account of the existence of categories B shares that provide a preferential dividend right for an amount corresponding to 65% of the carried interest provided in Inventures SA for the benefit of MyMicroInvest SA.

Revenue projections

Revenues are the results of the above assumptions. The figures below are in euros.

Lower revenues are observed in 2019 since MyMicroInvest does not take any more fees after 6 years. MyMicroInvest therefore no longer receives any compensation from investors who subscribed before 2015. However, the resale of Inventures shares in 2020 should result in the payment of carried interest.

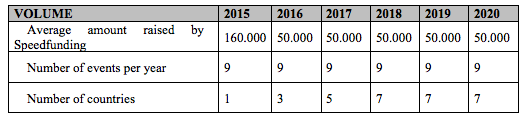

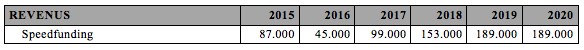

C. Speedfunding events

Volume projections

MyMicroInvest organises an average of 9 speedfunding events per year. Given the internationalisation strategy, the financial plan has assumed that these events will take place in each country where MyMicroInvest is active. The financial plan forecasts that an average of 50,000 EUR (average amount raised by Speedfunding) should be invested in the companies presented at the end of a speedfunding event.

Price projections

MyMicroInvest charges the company presented 6% of the amounts raised through the speedfunding events.

Revenue projections

Revenues are the results of the above assumptions. The figures below are in euros.

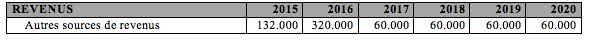

D. Other revenue

Other revenue primarily consists of: subsidies granted, in particular, by the Belgian federated and federal entities and the income derived from involvement in European projects sponsored by the European Commission. The figures below are in euros.

Conclusion on revenue

The sum of the income from all MyMicroInvest activities is set out below. The figures below are in euros.

Cost drivers

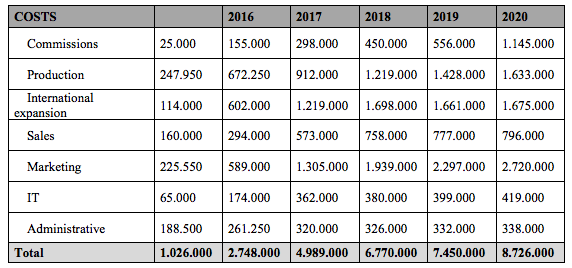

The cost projections of MyMicroInvest can be broken down into the following two categories:

- Commission and production costs:

- The commissions on the amounts raised are paid to the partners who collaborated in the sourcing of entrepreneurs, to partners who introduced investors during the speedfunding events and to partners who helped the company obtain subsidies.

- Production costs: these costs include fees for financial analysis, legal costs, review costs by external legal counsel and salaries. The costs of review by external legal counsel should cease no later than 1 January 2017 after which the review will be carried out internally.

- Production costs: these costs include fees for financial analysis, legal costs, review costs by external legal counsel and salaries. The costs of review by external legal counsel should cease no later than 1 January 2017 after which the review will be carried out internally.

- General overheads, administrative and selling costs:

These costs include:

- Internationalisation costs: development of the structure, salaries, office, etc.;

- Sales costs: salaries, events, representation;

- Marketing costs: salaries, acquisition costs;

- IT costs: salaries, server operation and other fixed costs;

- Administrative costs: salaries, rent, office expenses, accounting, auditing, taxes.

- Sales costs: salaries, events, representation;

- Marketing costs: salaries, acquisition costs;

- IT costs: salaries, server operation and other fixed costs;

- Administrative costs: salaries, rent, office expenses, accounting, auditing, taxes.

Details of the total costs are shown in the table below. The figures are expressed in euros.

Financial tables

The financial plan below is the result of the assumptions explained above.