Screening Media 1A

The video sales accelerator for Belgian midsize retailers

€141,550

total amount raised in round

103%

Campaign Closed

Historical accounts

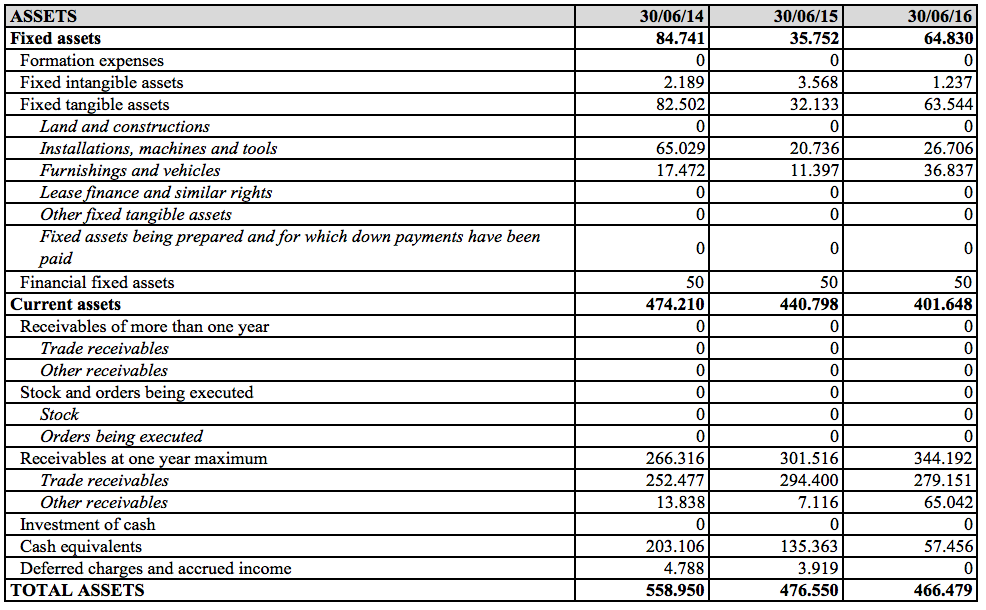

ASSETS

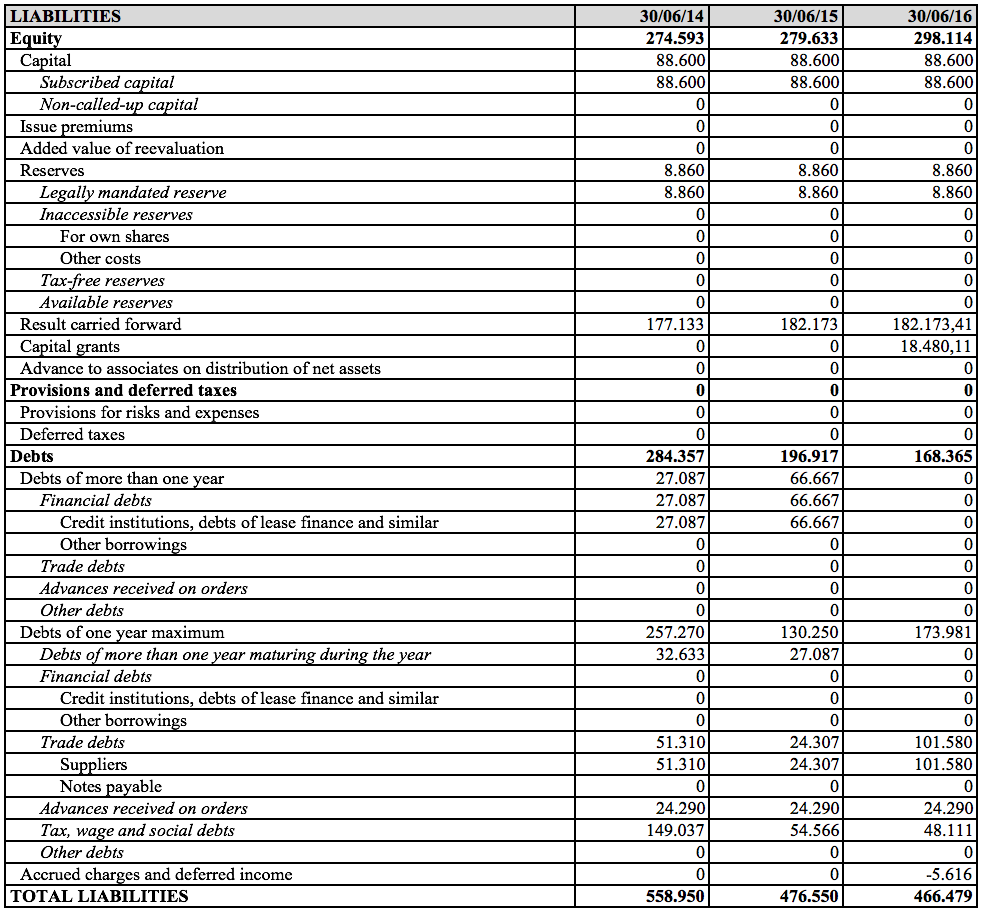

LIABILITIES

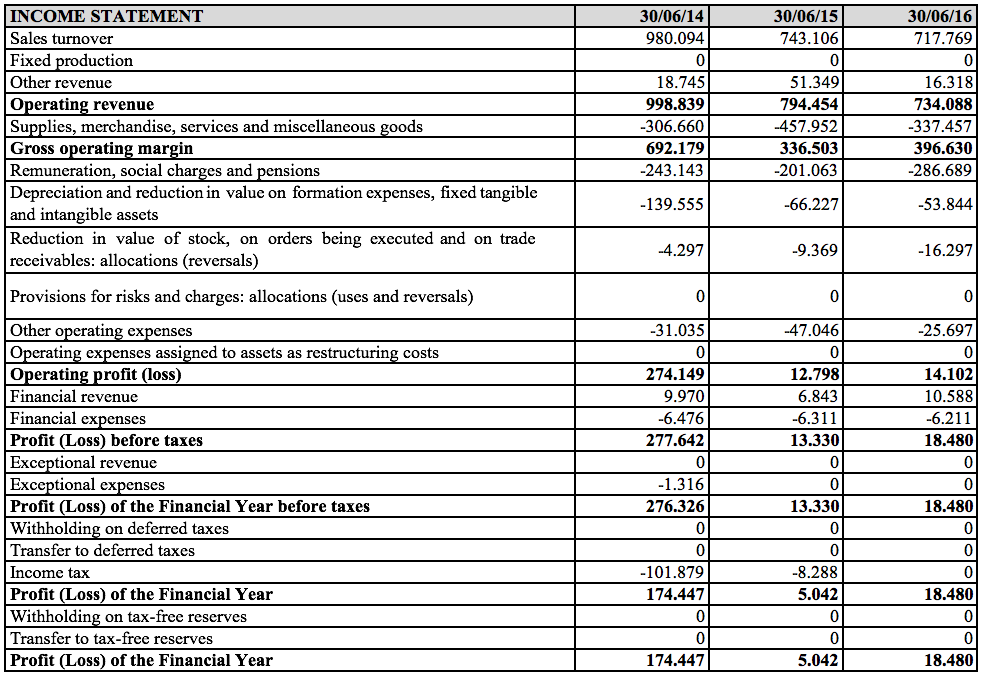

INCOME STATEMENT

Screening Media had a strong year in FY2016 (Fiscal year closing in June). The company grew 15% in sales (with Total revenues above 780k, however fiscal accounts only include 11 months of invoices due to a change in accounting rules)

Financial plan

Screening Media has the ambition to grow fast. In this model, the company has built a model showing the reasonable ambition (middle scenario presented here).

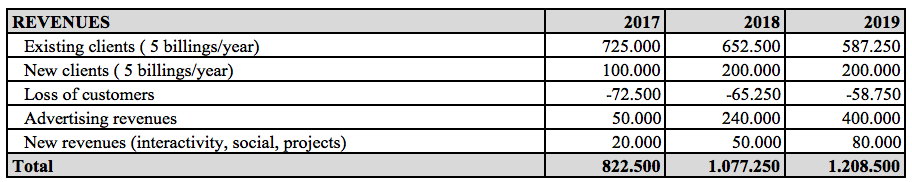

Revenue drivers are well known

- Increasing number of partner shops to allow expanding the local announcers footprint.

Costs drivers/ USE OF COLLECTED FUNDS

- Financing of 2 months delay between cash disbursement at our suppliers and cash payments (Current buy rate rythm is 50k per quarter)

- Financing of 20 TVs that will stay property of the company and be rented (investment of 25k)

-Financing of negative cash flows of every new contract (4 months on average to recover the cost of sales on a new monthly local contract)

Revenue drivers are well known

- Increasing number of partner shops to allow expanding the local announcers footprint.

Costs drivers/ USE OF COLLECTED FUNDS

- Financing of 2 months delay between cash disbursement at our suppliers and cash payments (Current buy rate rythm is 50k per quarter)

- Financing of 20 TVs that will stay property of the company and be rented (investment of 25k)

-Financing of negative cash flows of every new contract (4 months on average to recover the cost of sales on a new monthly local contract)

Revenue drivers

Screening Media will achieve a growth of sales of minimum 20% thanks to a rapid development of its core shop network (40 new shops per year) generating a strong growth in total client base. The company sells an average of 8 announcers per shop. Adding 120 new shops in three years will enable the company to double its total client base in same time frame.

Shop contracts are of five years minimum and they are automatically renewed. Local announcers contracts range from 2 to 6 years (3.4 on average).

For local announcers, the average revenue per year is 1200€, and SM has used this Price as hypothesis for the future three years.

Shop contracts are of five years minimum and they are automatically renewed. Local announcers contracts range from 2 to 6 years (3.4 on average).

For local announcers, the average revenue per year is 1200€, and SM has used this Price as hypothesis for the future three years.

Screening Media has revenues from Shops and Local advertisers. The business case is built on the key hypothesis that the company will install 40 new shops per year (and therefore needs some working capital). Any new shop generate short term 5 000€ to 9 000€ of revenues (sales of material) and a total of 10.000€ advertising revenues per year over next five years.

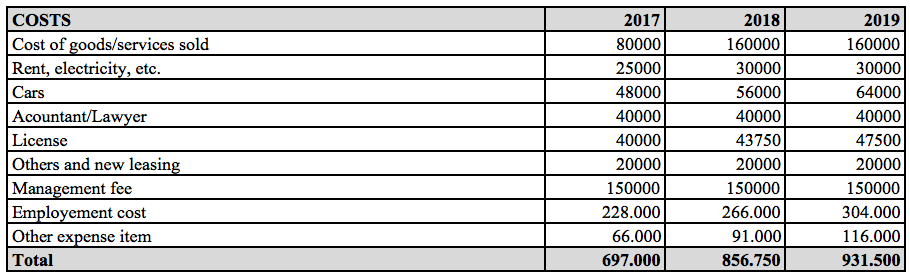

Cost drivers

Screening Media online platform

The main costs of Screening Media are

- people with hypothesis of growing by one to two FTE per year

- licenses of 4 to 10€ per screen

Screening Media buys and sells material with a standard 10% margin (main supplier today is LG for screens with builtin players)

- people with hypothesis of growing by one to two FTE per year

- licenses of 4 to 10€ per screen

Screening Media buys and sells material with a standard 10% margin (main supplier today is LG for screens with builtin players)

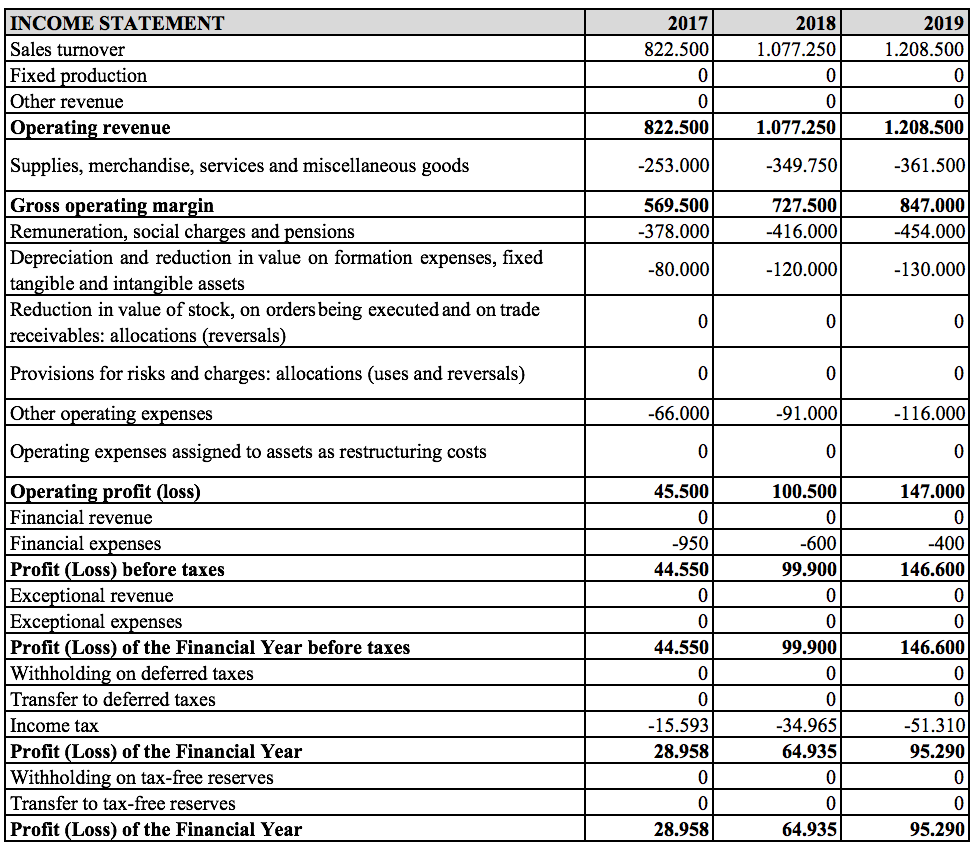

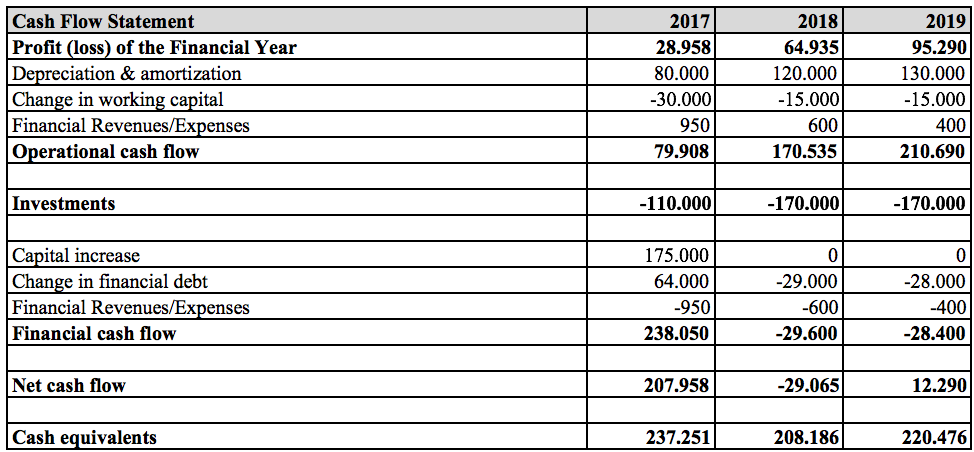

Financial tables

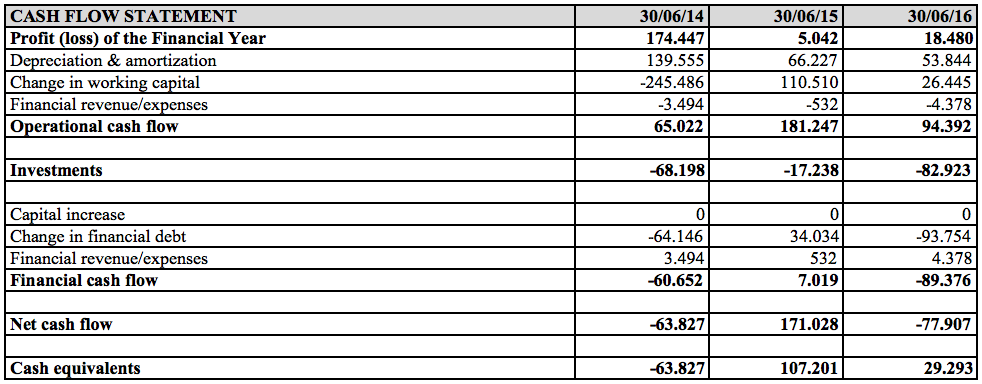

Screening Media has always delivered a positive result (net income) and the result of the company will grow in line with revenues in the future.

Break even volume

The company is profitable today, and intends to remain profitable in next years. The capital increase is needed to finance the growth of the shops network.