Turbulent 1A

The most profitable micro hydro power plant

€1,600,000

total amount raised in round

250%

- Backed by over 160 investors

- Eligible for a tax reduction

Campaign Closed

I. Existing Shareholders

Before the capital increase in which Spreds Finance will participate at the end of the offer, the entrepreneurs of Turbulent jointly hold 81,50% of the shares of the company while the external investors hold jointly 18,50% of the shares.

II. Forecasted Capital Increase

The capital increase to which Spreds Finance will participate is part of a broader funding of Turbulent of minimum 1,500,000 EUR and maximum 2,000,000 EUR. This funding will be allocated as follow :

- Between minimum 100,000 EUR and maximum 250,000 EUR will be subscribed by Spreds Finance based on the results of the issuing Notes (1 Note = 500 EUR). Please bear in mind that for the present campaign, the total financing that can be obtained through the crowd amounts to 250.000 EUR, but is however limited to a subscription per investor of 5.000 EUR, as per the exemption of art. 18, §1, k) of the Law of 16 June 2006 on the Public Offering of Investment Instruments and the Admission of Investment Instruments to Trading on a Regulated Market.

- A minimum of 1,250,000 EUR and a maximum of 1,900,000 EUR will be invested by other investors.

The value of the company before this increase in capital is presently estimated to be a maximum of 2,500,000 EUR. Following this increase in capital, the value of the company will be between 4,000,000 EUR and 4,500,000 EUR meaning an estimated valuation of 2,500,000 EUR before an increase of capital going from 1,500,000 EUR up to 2,000,000 EUR.

Before the capital increase, the existing shares will be replaced so that there are 2,500,000 shares, 2,500,000 EUR representing the value of the company before the capital increase, expressed in EUR. This does not affect the present and future allocation of shares.

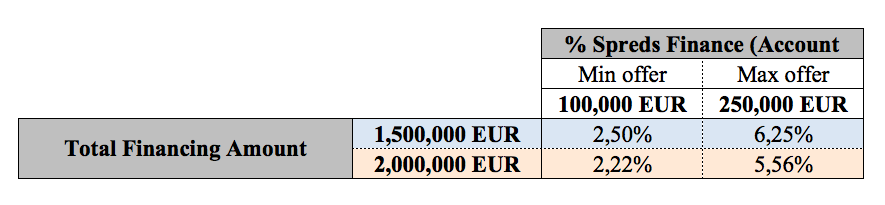

The table below presents the percentages of the capital held by the Turbulent account of Spreds Finance depending on the results of the Notes issue (i.e., a minimum of 100,000 EUR and maximum of 250,000 EUR) and the minimum and maximum amounts contributed by the other investors (i.e., a minimum of 1,250,000 EUR and a maximum of 1,900,000 EUR).

- Between minimum 100,000 EUR and maximum 250,000 EUR will be subscribed by Spreds Finance based on the results of the issuing Notes (1 Note = 500 EUR). Please bear in mind that for the present campaign, the total financing that can be obtained through the crowd amounts to 250.000 EUR, but is however limited to a subscription per investor of 5.000 EUR, as per the exemption of art. 18, §1, k) of the Law of 16 June 2006 on the Public Offering of Investment Instruments and the Admission of Investment Instruments to Trading on a Regulated Market.

- A minimum of 1,250,000 EUR and a maximum of 1,900,000 EUR will be invested by other investors.

The value of the company before this increase in capital is presently estimated to be a maximum of 2,500,000 EUR. Following this increase in capital, the value of the company will be between 4,000,000 EUR and 4,500,000 EUR meaning an estimated valuation of 2,500,000 EUR before an increase of capital going from 1,500,000 EUR up to 2,000,000 EUR.

Before the capital increase, the existing shares will be replaced so that there are 2,500,000 shares, 2,500,000 EUR representing the value of the company before the capital increase, expressed in EUR. This does not affect the present and future allocation of shares.

The table below presents the percentages of the capital held by the Turbulent account of Spreds Finance depending on the results of the Notes issue (i.e., a minimum of 100,000 EUR and maximum of 250,000 EUR) and the minimum and maximum amounts contributed by the other investors (i.e., a minimum of 1,250,000 EUR and a maximum of 1,900,000 EUR).

III. Extra Information

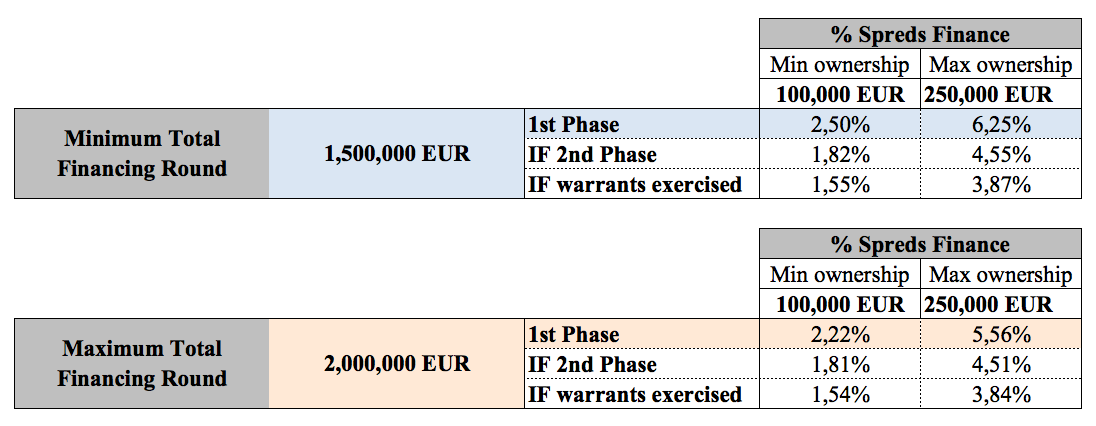

(1) The co-investor agreed to invest in Turbulent in two phases: 50% now, and, 50% in maximum 3 years at a valuation of 6,500,000 EUR if the company reaches its predefined milestones. Together, with the company and the co-investors, in order to avoid complexity and blocking commitments from Spreds' investors, we have agreed that Spreds Finance would not be part of that second phase, which means that, by subscribing to these Notes, you won't be able to exercise your preferential right for that specific next round. As a result, the crowd will be automatically diluted up to 27% depending on this Notes issuance.

(2) Warrants are planned aiming to incentivise the management of Turbulent. Those would occur after the 2nd Phase and Spreds Finance ownership could be diluted up to 38%.

The Table underneath illustrates the ownership variation if (1) & (2) occur:

(2) Warrants are planned aiming to incentivise the management of Turbulent. Those would occur after the 2nd Phase and Spreds Finance ownership could be diluted up to 38%.

The Table underneath illustrates the ownership variation if (1) & (2) occur:

IV. Co-investors

Besides the potential participation of historical investors, the majority of the financing round will be funded by two major co-investors: Inventures and Victrix.

Inventures is an early stage venture capital fund investing in businesses that support the transition towards a more sustainable world.

Victrix is an investment holding with a strong focus on (the transformation into) sustainable industries.

Inventures is an early stage venture capital fund investing in businesses that support the transition towards a more sustainable world.

Victrix is an investment holding with a strong focus on (the transformation into) sustainable industries.