Pipaillon 1A

Producer of organic luxury jams, chutneys and tapenades

€111,100

total amount raised in round

- Backed by over 80 investors

Campaign Closed

Organic Trends

In Belgium: since 2008, the organic food market share has increased up to 6% (in 2017) and this trend is accelerating. The Belgian Organic Market represented 632M€ in 2017.

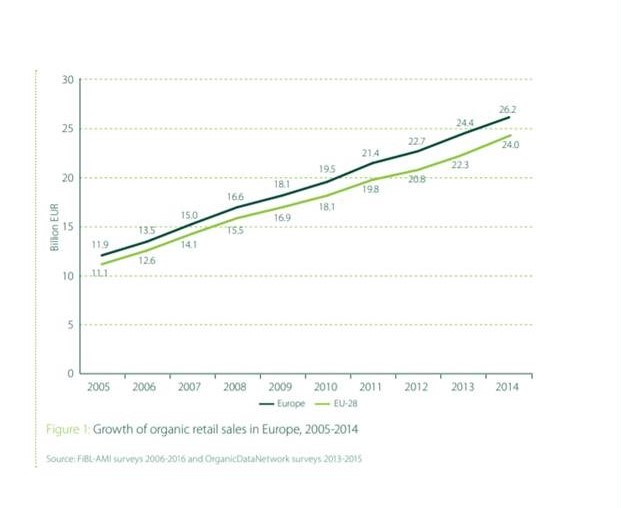

Growth of organic retail sales in Europe 2005-2014

The growth of organic retail sales in Europe has reached €30,7 Bn in 2016. The European organic market has grown by 371% since the year 2000. The Food industry is now proposing the same ranges of ultra-processed food products (out of which vegan, gluten-free, light, lactose-free). At world level, the organic market has reached €84,7 Bn in 2016 (X 5,6 since 2000).

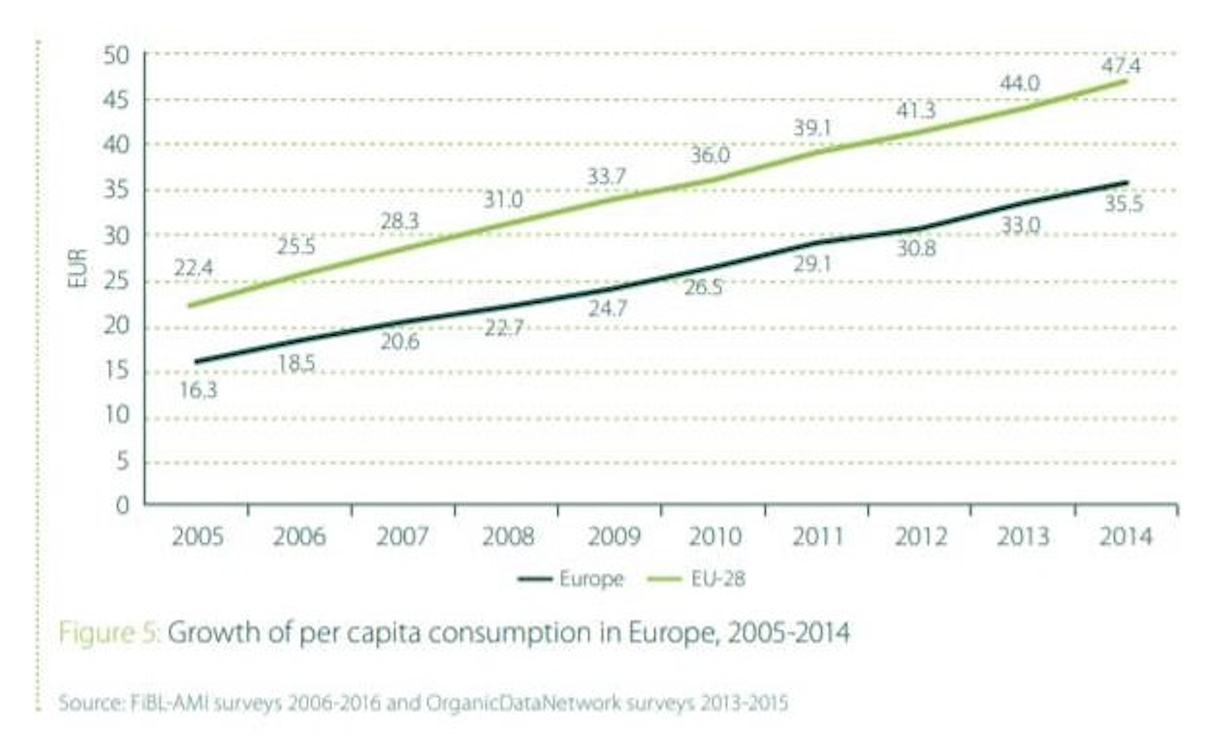

Growth of per capita consumption in Europe 2005-2014

Consumer per capita consumption of organic food has almost doubled in the last decade (see figure 5). EU consumers spent around €47 per capita on organic food in 2014 (€36 in Europe, with the Swiss spreading the most on organic (€221)). After Switzerland, the countries with the highest per capita consumption of organic food include Luxembourg (€164), Denmark (€162), and Sweden (€145). Care must be taken in interpreting these figures as the costs of living across different countries differ quite considerably. Nevertheless, even if adjusted by purchasing power, Switzerland still holds the first place, followed by Luxembourg, Denmark and Sweden.

Pipaillon is all about...

Pipaillon's essentials are simplicity, common sense, transparency and pleasure.

Consumers are increasingly aware of the drifts in the food industry. They are demanding more transparency on the production processes and are ready and willing to pay for authentic artisan-made products. And this is what Pipaillon offers.

Consumers are increasingly aware of the drifts in the food industry. They are demanding more transparency on the production processes and are ready and willing to pay for authentic artisan-made products. And this is what Pipaillon offers.

The Target Customers

Big city life, concrete jungle, the lifestyle of today’s city dweller is increasingly separated from nature and simple pleasures. Seeking to reconnect to their roots and childhood memories, consumers increasingly gear towards organic food - good for them and the environment. At the same time, educated consumers demand more transparency and are eager to be treated with respect. They will rapidly discard Corporations' shallow green-washing marketing campaigns that only put an up-to-date polish on an otherwise industrial product that offers no real differences in terms of consequences on their own health and the planet.

Through taste and transparency, Pipaillon’s line of products is bringing back memories from childhood, when seasonal harvests were slowly cooked in an ecstasy of flavours. It targets epicurean urban hedonists, demanding for themselves and aware of the implications of their consumption behaviours.

In short:

o Amateurs of local and organic food products

o Hedonists and epicureans

o Young urban professionals in search of pleasure and authenticity

o Amateurs, who activate their childhood memories

o Travelers (F&B market)

Through taste and transparency, Pipaillon’s line of products is bringing back memories from childhood, when seasonal harvests were slowly cooked in an ecstasy of flavours. It targets epicurean urban hedonists, demanding for themselves and aware of the implications of their consumption behaviours.

In short:

o Amateurs of local and organic food products

o Hedonists and epicureans

o Young urban professionals in search of pleasure and authenticity

o Amateurs, who activate their childhood memories

o Travelers (F&B market)

Actual market - Belgium

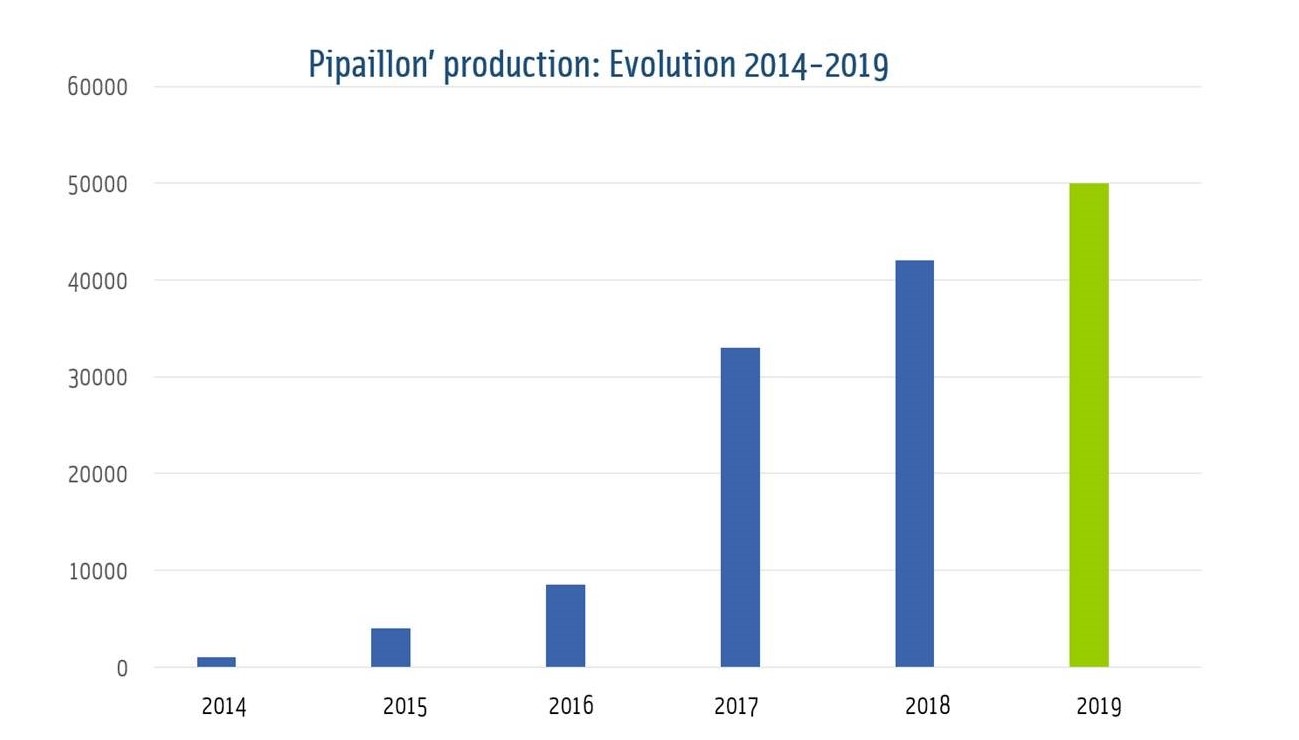

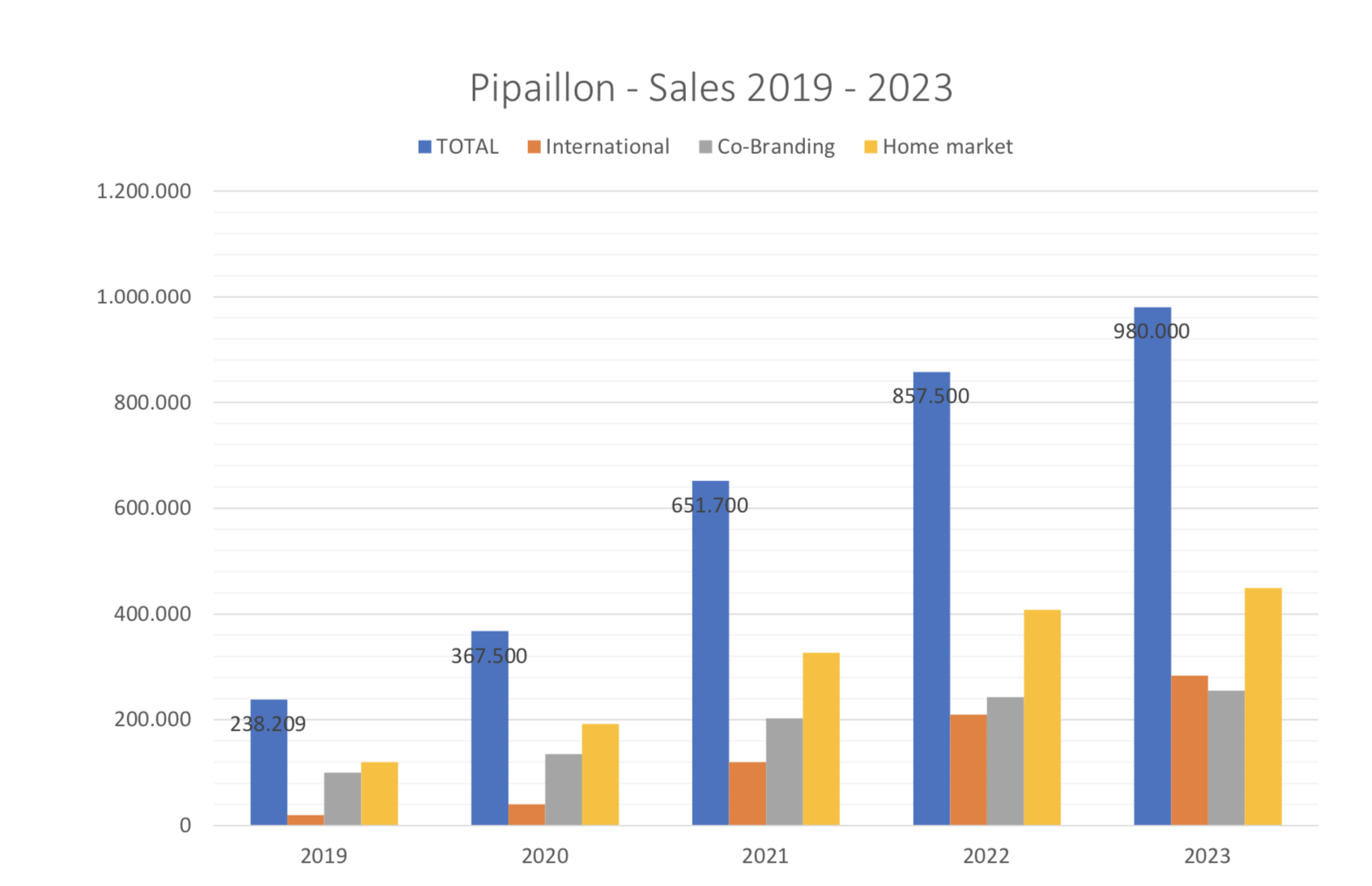

Pipaillon started selling its preserves in 2014, at Pipaillon coffee and jam bar. Progressively, the brand became widely distributed in Belgium mainly in organic stores and delicatessen. Pipaillon has seduced boutique hotels & restaurants with a specific F&B range.

As from 2017, Pipaillon started co-branded productions.

With Rob Gourmet Market: co-branding of seasonal jams & Pipaillon range.

With CRU (3 markets): co-branding of a seasonal range of jams and chutneys.

With BioPlanet: development of a full and exclusive line of premium jams and chutneys.

As from 2017, Pipaillon started co-branded productions.

With Rob Gourmet Market: co-branding of seasonal jams & Pipaillon range.

With CRU (3 markets): co-branding of a seasonal range of jams and chutneys.

With BioPlanet: development of a full and exclusive line of premium jams and chutneys.

In Europe & beyond

Since 2019, Pipaillon also developing in Germany and in Asia (Korea and Japan), where there is a high demand for luxury and handmade food products.

Perspectives

Pipaillon’s ambition is to replicate the concept of local ateliers, as close as possible to the crops, around Europe and the world.

Next steps:

- Development of other formats and segments (F&B - cheese makers - delicatessen stores);

- Development of the salted range;

- Development of Pipaillon stores

Next steps:

- Development of other formats and segments (F&B - cheese makers - delicatessen stores);

- Development of the salted range;

- Development of Pipaillon stores